Energetics doesn’t believe that the Power of Choice reforms should be seen as a catalyst for all embedded network customers to suddenly jump ship and seek a contestable on-market retail contract. A well run embedded network can deliver value for both its operator and its customers. In this article we discuss the features of the new provisions under Power of Choice and how they apply to operators and customers – and the opportunities for both.

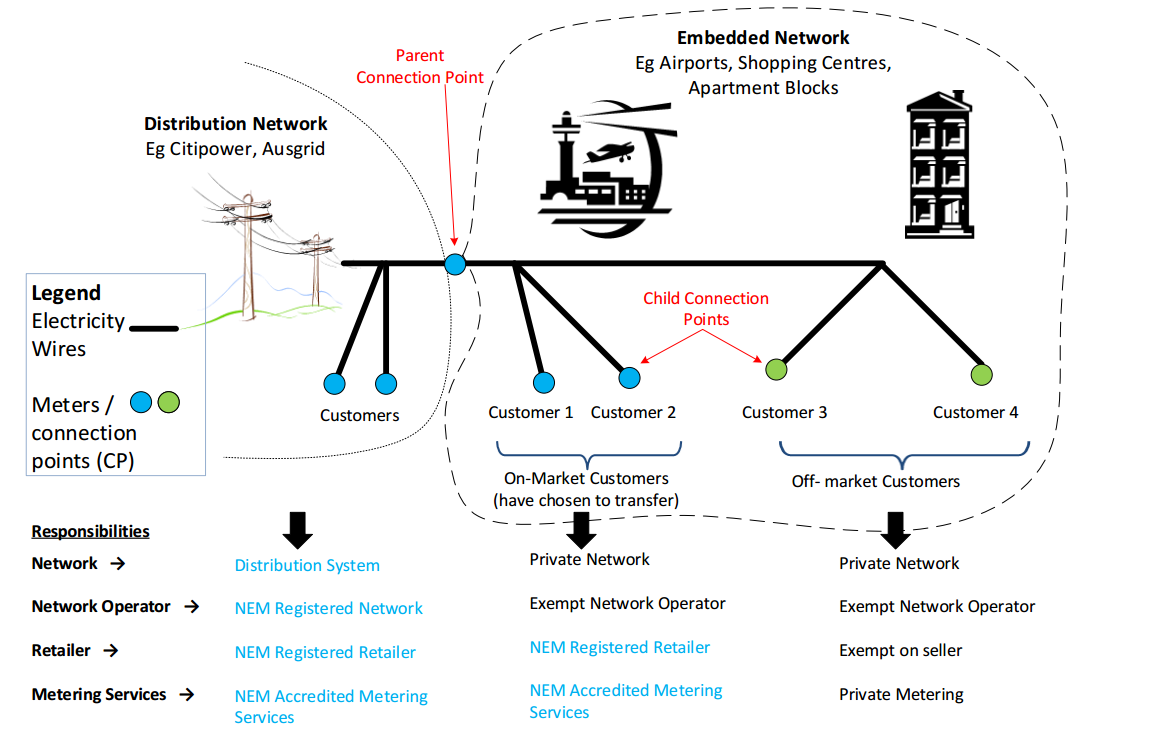

Shopping centres, commercial buildings, apartment blocks and caravan parks have all commonly on-sold electricity to their tenants. The Australian Energy Regulator (AER) refers to these arrangements as Embedded Networks. Embedded networks allow for tenants to aggregate their loads under a single ‘Parent’ meter, taking advantage of their combined consumption when negotiating a retail electricity contract. The embedded network operator, typically the landlord (parent meter), will generally administer the electricity contract directly with a retailer, and thereafter apportion the costs between tenants (child meters). This arrangement is illustrated in the figure below.

Figure 1: Embedded network operations[1]

To date, many larger embedded network operators have had to register with the AER and comply with a number of conditions, as set out in their Exempt Selling Guidelines (Retail and Network). These conditions are primarily aimed at ensuring that tenants/customers are adequately protected, and include:

- an obligation to supply

- minimum information provisions

- billing and payment arrangements

- methods for billing estimations

- pricing guidelines

- under and overcharging guidelines

- maintenance of records

As of the 1 December 2017 a number of additional rules have however come into effect. Part of the broader Power of Choice reforms, the rules have placed additional obligations on embedded network operators, and reduced the barriers for tenants wishing to leave an embedded network and seek a contestable on-market retail contract.

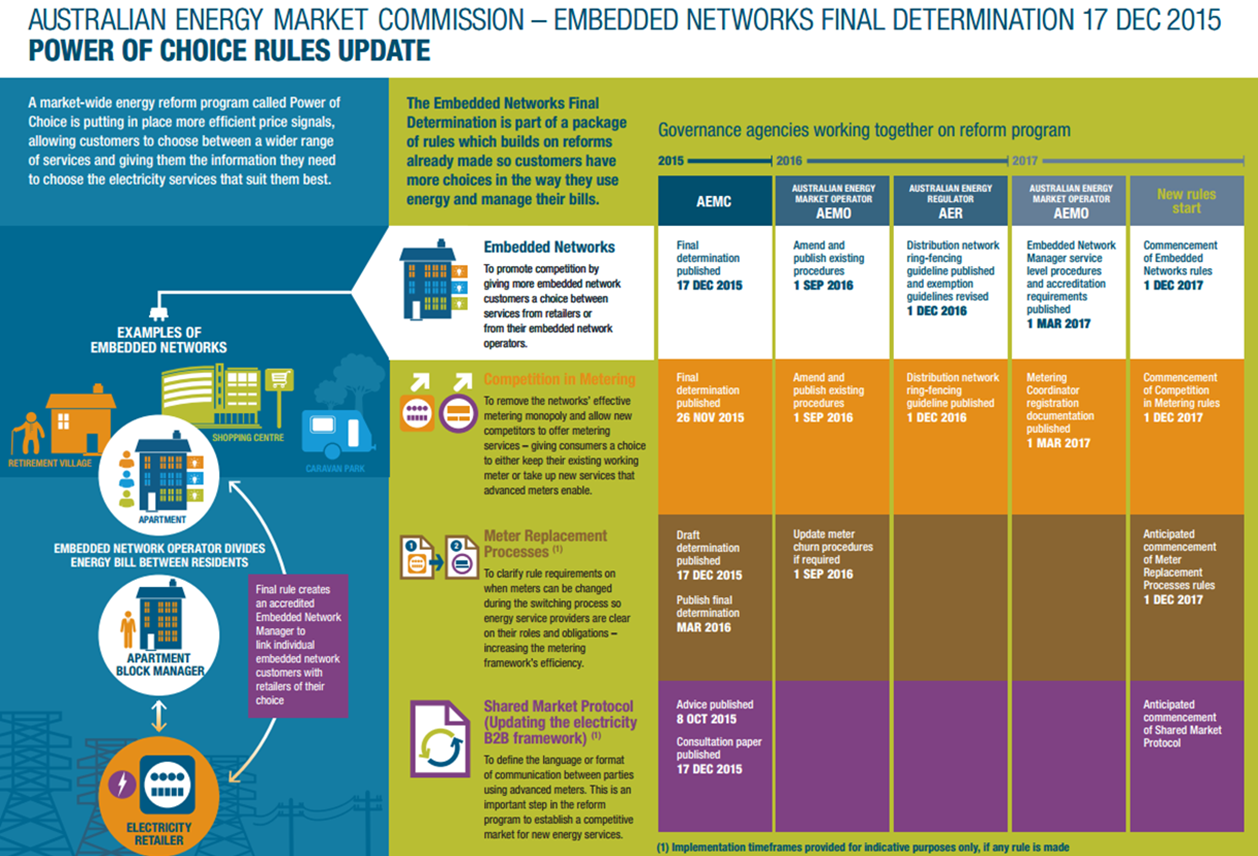

These rules are intended for jurisdictions covered under the National Electricity Customer Framework (ACT, NSW, Qld, SA and Vic). A summary of the broader Power of Choice reforms, the involvement of various government agencies, as well as a timeline of their implementation is provided in the figure below.

Figure 2: Embedded networks final determination (Source: AEMC)

So what do the Power of Choice reforms mean for your business?

Embedded network customers

If you have a site that is currently part of an embedded network, the reforms will make it much easier for you to seek an alternate on-market, contestable retail contract for the site. This access to retail competition will allow you to seek a broader range of electricity offers, some of which may be lower than that offered within the embedded network. Importantly, should you choose to leave, it is important to check you aren’t double charged for distribution network charges. Previously, these would have been apportioned and passed through by the embedded network operator based on what they were charged, however a retailer may similarly include these charges on their invoice.

Embedded network operators

One of the fundamental rule changes introduced by the AEMC is the creation of the role of an Embedded Network Manager (ENM). An ENM will be the entity responsible for facilitating the relationship between customers of an embedded network (child meters) and the broader National Electricity Market (NEM). Effectively the ENM will provide a NMI to customers of the embedded network, who want to go on-market, ensuring that these customers are accurately appearing in NEM systems (MSATS).

The embedded network owner will be responsible for appointing the ENM. The ENM will then be contracted by the embedded network owner to administer the embedded network – or at least to fulfil the obligations of the ENM. The Australian Energy Regulator (AER) has introduced a grace transitional arrangement period extending the deadline to appoint an ENM up till 31st March 2018 for eligible embedded network operators. AEMO publishes an up to date list of accredited ENMs on its website.

Importantly embedded network operators now need to account for the risk that some of its customers may start to seek on-market contracts. This risk will therefore needs to be accounted for in the load forecasts and volume flexibility of any future large market electricity negotiations.

Embedded networks can benefit both property owners and end users

The aggregated loads of tenants, through the use of a single parent meter can give access to electricity rates that each party otherwise wouldn’t be able to access independently. The challenge then comes in finding an optimal price of electricity for tenants; one which can provide both an income stream to the operator (covering the additional costs of operating such a network) whilst still providing tenants with greater savings than they would otherwise be able to negotiate independently with an on-market retailer.

Energetics can provide further insights and advice on your business’ individual circumstances. Please contact the author or any of our experts for more information.