ASRS reporting readiness

In a previous article, Energetics explained our ASRS Readiness Assessment and presented a summary of the results from the first 100 respondents. Our dataset has now grown to 187 respondents which we have added to the analysis. What we have found is that, while the data set has almost doubled, the results have remained consistent. The most significant outcomes are:

- 75% of the companies that completed the survey are ready to report[1].

- 53% of the dataset are NGER reporters, they are well better placed than non-NGER reporters to meet ASRS requirements.

- Group 1 reporters (the first cabs off the rank from 1 January 2025) are best placed to report with an average score of 3.4.

- Companies from the Financial Services, Energy and Mining and Manufacturing sectors are well-placed to report. Concerns are held for companies in the Agricultural and Government, Health and Education sectors as they have scored an average below 3.

- Across the themes of the reporting frameworks, Strategy presents as an area of concern and where Australian companies need to focus their development activities.

In assessing different aspects of the reporting framework we can conclude what is being done well and where areas of concern lie.

|

Good |

Okay |

Needs work |

Significant gap |

|

|

|

|

Please find a complete analysis of the results here.

ISSB reporting readiness

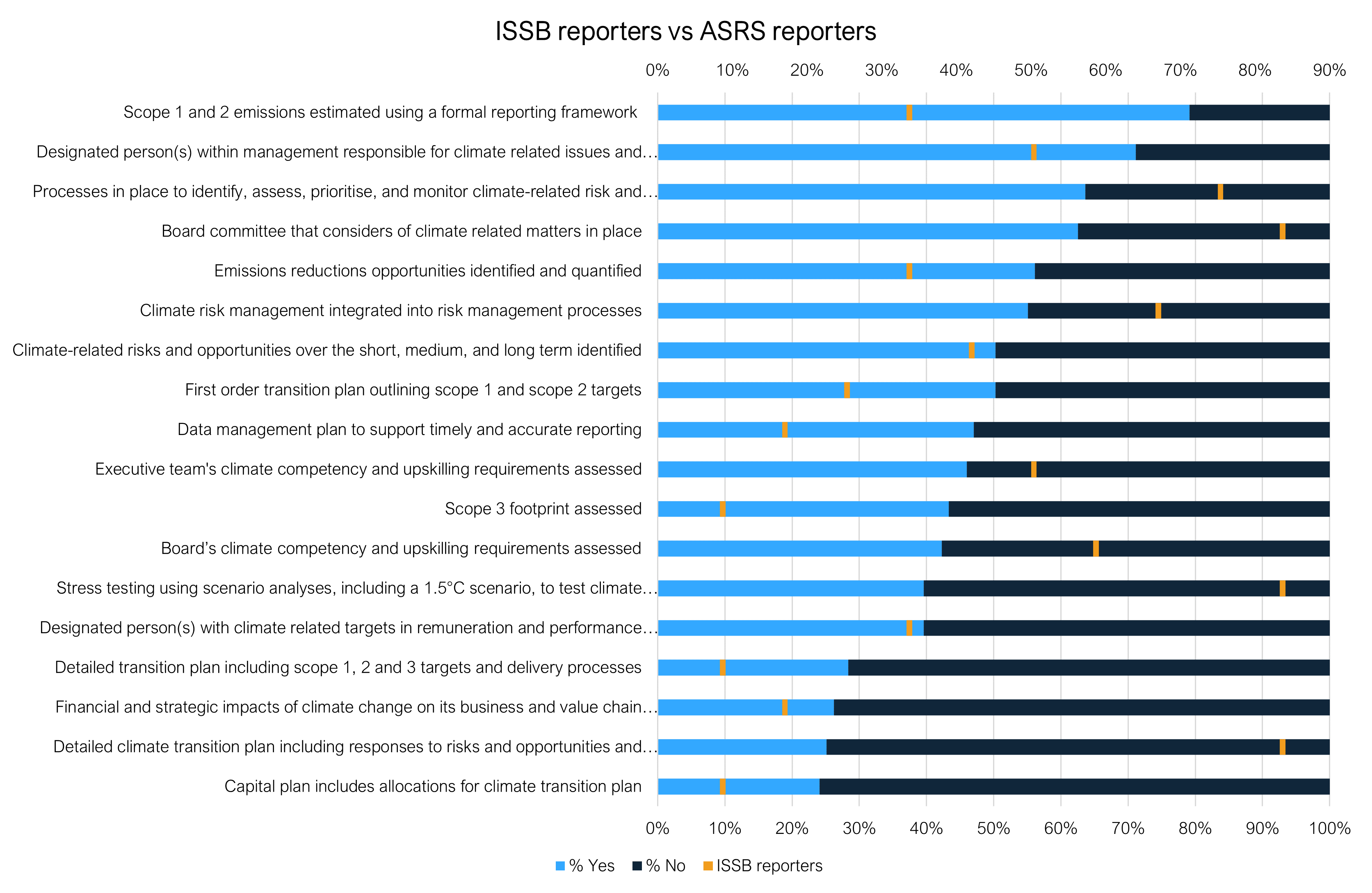

We have also published a readiness survey developed to assess reporting readiness for ISSB reporting requirements for companies not registered in Australia. We have had 12 responses to this survey which means that results are not statistically significant. However, some commentary is possible. The average score for these 12 companies is 3.5 which is higher than the ASRS reporters. More than 80% of the companies recorded a score of 3 or more. Average performance for ISSB aligned reporters is contrasted with ASRS reporters for interest. It would appear that there are distinctly different areas of good performance and gaps between the two reporting groups. We will watch how this evolves.

Figure 1: Readiness of international reporters (ISSB) compared to Australian reporters (ASRS)

Of interest is contrasting the performance in the four reporting themes between the two groups of reporters.

|

Governance |

Risk Management |

Metrics and Targets |

Strategy |

|

|

ISSB reporters |

55% |

71% |

21% |

47% |

|

ASRS reporters |

52% |

59% |

51% |

33% |

This result shows that the ISSB reporters are better placed to meet the Strategy and Risk management aspects of the frameworks, while ASRS reporters are better placed to meet the Metrics and Targets requirements. The Metrics and Targets result may be due to the rigours of NGER and its impact on disclosure in Australia. It will be interesting to unpack these results going forward to assess what Australian registered companies have to learn from their international counterparts.

Next steps

Energetics will continue to update our analyses of company responses and to build solutions which meet the gaps we can see in the understanding of our clients. We know that there are sectors which require more attention, and that there are some focus areas for development. Australian companies can learn from their international counterparts about Strategy and Risk Management, and international companies can learn from Australian companies about their work on Metrics and Targets. In our next analyses we will start to unpack these themes in more detail, and will focus on the requirements of specific sectors.

[1] The survey has been designed so that an achievement of 3 means that you are likely to be ready to report for the FY24/25 with the understanding that there will be limited assurance on scope 3, transition plans, and physical risk assessments.