Gas customers on the east coast of Australia have had a wild ride over the last five years. The challenges date back to 2015 when three multi-billion dollar Liquefied Natural Gas (LNG) export projects were first commissioned at Curtis Island, Queensland. The three LNG terminals now consume almost two thirds of the east coast’s gas production on a daily basis, with the resulting linkage of domestic gas prices to international LNG prices causing much angst amongst domestic gas customers. Spot gas prices more than doubled on 2015 levels to $8-10/GJ for the majority of 2017-2018. Then COVID-19 hit, wreaking havoc on international oil and gas markets. Prices plummeted following an unprecedented collapse in global demand. Local spot prices reached a low of $4/GJ in mid-2020.

As we begin to see a recovery from the pandemic in 2021, what can we expect for gas markets this year and what does the future of gas look like beyond 2021? What are the implications for gas consumers in Australia and their long-term contracting strategies?

In this article, we look at the key factors influencing domestic gas prices – from international LNG demand through to the oil price and the impacts of COVID-19 on the gas industry.

International LNG price linkage to domestic gas prices: how does it work?

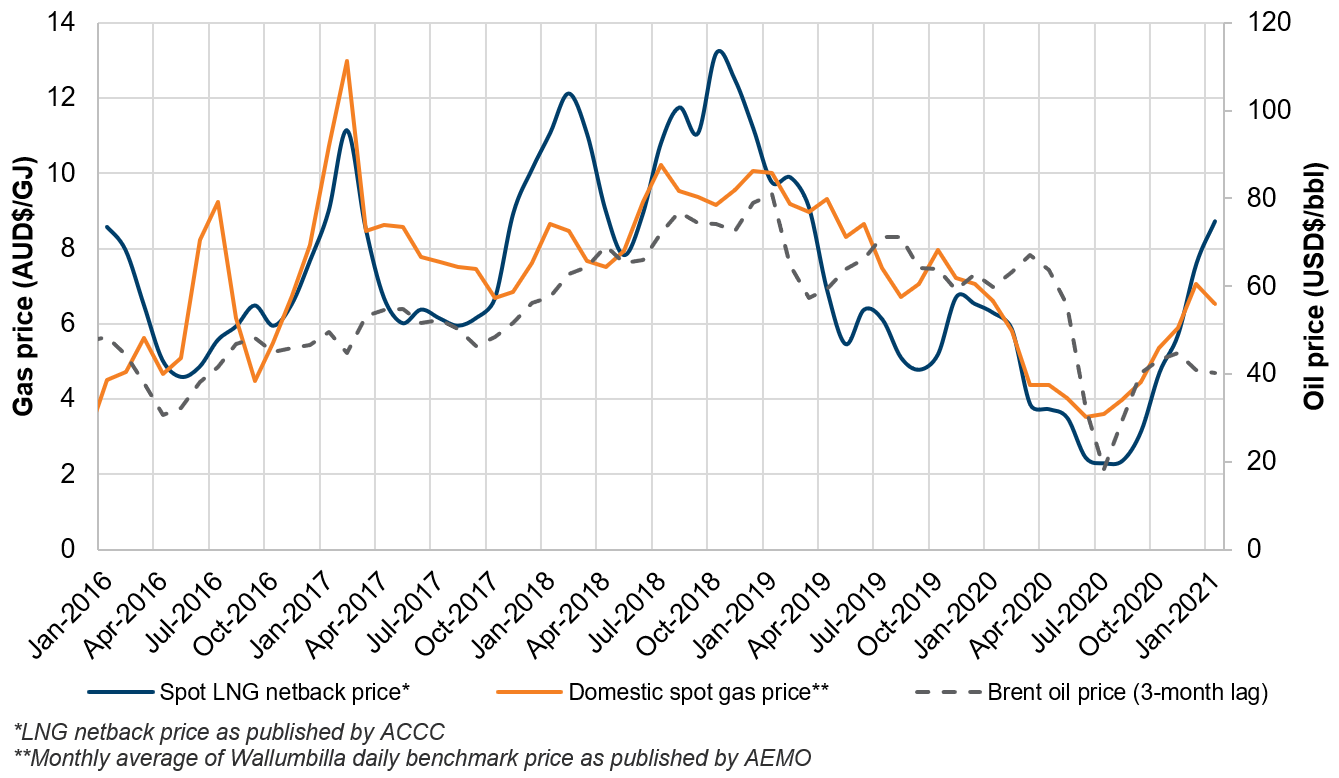

With Australia endowed with an abundance of natural gas resources, the question is often asked – how is it possible that international commodity prices influence our domestic gas prices? The answer lies with the principle of opportunity cost. An uncontracted molecule of gas produced in Australia can either be sold into the domestic market or converted to LNG and sold internationally. The ACCC’s published LNG netback price series takes the Asian LNG spot price (JKM)[1] and converts it to an equivalent price for the same molecule of gas if it were to be sold at the Wallumbilla Gas Supply Hub in Queensland (with price adjustment made to account for liquefaction and the transportation costs of LNG). This netback price represents an LNG exporter’s opportunity cost of selling an uncontracted molecule of gas into the domestic gas market, and therefore the price that domestic buyers are competing against for uncontracted gas supplies. The influence on domestic spot gas prices that is brought about by this competition is illustrated in Figure 1 below, with a strong correlation between the spot LNG netback price and domestic gas prices observed over the last five years.

However, with over 90% of east coast LNG being sold on long-term contracts rather than as spot cargoes, the pricing mechanisms in these contracts arguably play a more significant role in influencing domestic prices. These long-term contracts with international buyers are typically structured with pricing mechanisms linked to oil price with a three to six month lag[2]. The strong correlation between domestic spot gas prices and movements in Brent oil (with a three-month lag applied) is also demonstrated in Figure 1.

Figure 1: Correlation between domestic gas price and international LNG prices[3]

The forces driving the boom-bust cycle over 2020

With the domestic market in Australia exposed to the boom-bust cycle of international oil markets through LNG price linkage, consumers are feeling the effects of the ups and downs of the commodity price rollercoaster. After a period of record high prices in 2017-2018 brought upon by ramp up of LNG exports on the east coast and strong growth in Brent, 2019 saw the beginning of a decline in prices thanks to a global LNG supply glut. 2020 continued the downward trend with the unprecedented demand shock in oil and LNG markets brought on by COVID-19 lockdowns. Despite domestic demand for gas only seeing minor reductions during this period[4], domestic spot prices sunk to a low of just below $4/GJ in July[5] as the east coast market was awash with excess supply. LNG producers reported using a range of measures to manage excess supplies in their portfolios as LNG buyers exercised downward quantity tolerance (DQT) provisions in their long-term contracts[6]. These measures included taking less gas under third party contracts or joint venture arrangements, injecting more gas into storage where possible and turning down wells[7] as a last resort.

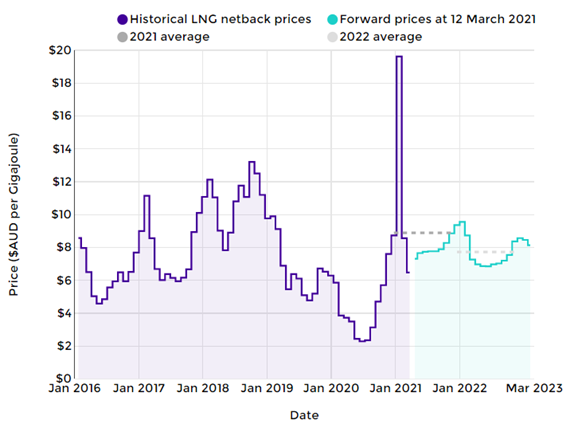

The last quarter of 2020 saw a strong recovery in prices with increased demand for LNG as the northern hemisphere entered a colder than average winter, further exacerbated by supply constraints and a lack of available shipping capacity. These conditions led to a record-breaking spike in JKM, with prices for spot deliveries of cargoes in February reaching US$18.31/MMbtu, equating to an LNG netback price of A$19.62/GJ at Wallumbilla[8] as seen in Figure 2. Whilst we did not see these extreme prices flow through to the domestic market due to the short-term nature of the shortage, it is a timely reminder of the volatility of international commodity prices and the potential exposure that domestic users face to these prices in the long term.

Figure 2: ACCC’s LNG netback price series as at 12 March 2021

Outlook for 2021 and beyond

As we look beyond the short-term peak in demand for LNG internationally, the outlook for 2021 shows LNG netback prices settling back in the range of A$6.50-$8.90/GJ, reflecting a more balanced LNG market internationally. However, the strong recovery in Brent oil price since November 2020 that has continued into 2021 will begin to flow through to long-term LNG contracts in the coming months, which is likely to put upward pressure on prices domestically as we head into our winter season. The oil price will be a key metric to monitor throughout 2021 with the global recovery from COVID-19, as it is a strong leading indicator of movements in prices in the domestic gas market due to oil price linkage through long term LNG contracts.

Looking beyond 2021, the Australian Energy Market Operator’s (AEMO) publication of its Gas Statement of Opportunities (GSOO) in March 2020 forecasted that the domestic market will be sufficiently supplied until 2023, after which they flagged that supply gaps could start to emerge during peak winter demand days in southern states. This concern was strengthened by the ACCC’s Gas Inquiry Interim Report released in January, signalling that the supply outlook for southern states in the medium to long term has tightened further and remains uncertain. Their analysis found that a potential shortfall of up to of 30 PJ per annum could emerge in the southern states as early as 2024 if further sources of supply are not developed. This concern in the market is consistent with the prices being offered by retailers for supply over the medium term, with a 20-30% increase in prices being offered to customers for supply in 2023 compared to 2022[9].

With the east coast staring down the barrel of a potential supply shortfall as early as 2024, where will the additional supply come from that is required to balance the market? Will consumers be left short and paying exorbitant prices at times of peak demand? Will LNG export controls imposed by the government be effective in securing sufficient supplies for the domestic market?

Santos’ Narrabri Gas Project is one of the potential new supply sources for southern markets, capable of supplying up to 200TJ/d into NSW[10]. However, despite receiving state and federal environmental approvals in late 2020, analysts predict that this project will only begin supplying gas to the market by 2025 if it goes ahead[11], too late to fill the supply shortfall identified for 2024. Proposed LNG import terminals in NSW and Victoria have a development timeframe of less than 18 months in some cases and are therefore gaining traction as the solution to filling the supply gap in the necessary timeframe. Australian Industrial Energy’s regasification project in NSW is the most advanced of the five proposed import terminals currently under development, signalling to the market that major works on their Port Kembla site would commence in 2021 with first gas to market by end of 2022. Uncertainty still remains around the affordability of this gas for domestic consumers, given that it will strengthen the linkage of our domestic prices to international LNG prices.

Meanwhile, tighter LNG export controls and/or a domestic gas reservation scheme are being called for by local industry to secure more gas for the domestic market and drive down prices. The Federal Government’s new Heads of Agreement[12] with the east coast LNG exporters has been criticised for being ineffective in delivering lower gas prices to Australian consumers, with the pricing mechanism included in the new agreement referencing the LNG netback pricing only. Whilst redirecting cargoes of LNG bound for export could help to increase supplies to the domestic market in Queensland, it will do little to address the forecasted shortfall in southern states as increased flows from the northern region will be limited by pipeline capacity constraints.

Energetics’ advice to business

So, what does this all mean for businesses who are contracting for gas in the east coast market? Customers may wish to consider a spot-price model offered by some retailers which could offer lower pricing under current market conditions compared to long term contract pricing as well as greater volume flexibility. However they need to consider their appetite for taking on budget risk when exposed to the ups and downs of a market exposed to the boom-bust cycle of international oil markets. If budget certainty is of greater importance, then a fixed price contract could be more suitable, and customers would need to consider their optimal contract term and timing for engaging the market to secure the best outcome for the business. Some larger gas customers may see benefit in becoming a direct participant in facilitated markets, however, they will need to consider the additional costs to their business in taking a more active role in managing price and volume risk. For more insights into gas markets and to discuss contracting strategies suitable for your business, please contact one of our experts today.

Footnotes

[1] Asian LNG spot price is based on S&P Global Platts JKM™, which is the LNG benchmark price assessment for spot physical cargoes. It reflects the spot market value of cargoes delivered ex-ship into Japan, South Korea, China and Taiwan.

[2] Grattan Institute (2020)

[3] Graph developed by Energetics based on data obtained from ACCC LNG Netback Price Series (2021) and AEMO Daily Gas Supply Hub Benchmark price report (2016-2021)

[4] Australian Energy Market Operator (2020)

[5] Monthly average Wallumbilla daily benchmark price as published by AEMO

[6] Australian Competition and Consumer Commission (2020)

[7] Turning down wells refers to choking back production from individual gas wells to limit their output. This comes with some risk of inhibiting future production from the well due to the potential for reservoir and downhole equipment damage.

[8] ACCC | Gas inquiry 2017 - 2025: LNG netback price series

[9] Based on recent tenders run by Energetics

[10] AEMO (2020)

[11] AFR | Santos under fire after Narrabri gas win

[12] The Heads of Agreement requires LNG exporters to offer uncontracted gas to the domestic market first on competitive market terms (referencing LNG netback price) before it is sold internationally in the spot LNG market

AEMO | Daily Gas Supply Hub Benchmark price reports 2016-2021

AEMO | Gas Statement of Opportunities March 2020

AEMO | Quarterly Energy Dynamics Q3 2020

ACCC | Gas inquiry 2017-2025 – Interim report January 2021

ACCC | LNG netback price series 2021

Grattan Institute (Tony Wood and Guy Dundas) | Flame Out: the future of natural gas, November 2020

[1] Asian LNG spot price is based on S&P Global Platts JKM™, which is the LNG benchmark price assessment for spot physical cargoes. It reflects the spot market value of cargoes delivered ex-ship into Japan, South Korea, China and Taiwan.

[2] Grattan Institute (2020)

[3] Graph developed by Energetics based on data obtained from ACCC LNG Netback Price Series (2021) and AEMO Daily Gas Supply Hub Benchmark price report (2016-2021)

[4] Australian Energy Market Operator (2020)

[5] Monthly average Wallumbilla daily benchmark price as published by AEMO [6] Australian Competition and Consumer Commission (2020)

[7] Turning down wells refers to choking back production from individual gas wells to limit their output. This comes with some risk of inhibiting future production from the well due to the potential for reservoir and downhole equipment damage.

[8] ACCC | Gas inquiry 2017 - 2025: LNG netback price series

[9] Based on recent tenders run by Energetics

[10] AEMO (2020)

[11] AFR | Santos under fire after Narrabri gas win

[12] The Heads of Agreement requires LNG exporters to offer uncontracted gas to the domestic market first on competitive market terms (referencing LNG netback price) before it is sold internationally in the spot LNG market AEMO | Daily Gas Supply Hub Benchmark price reports 2016-2021 AEMO | Gas Statement of Opportunities March 2020 AEMO | Quarterly Energy Dynamics Q3 2020 ACCC | Gas inquiry 2017-2025 – Interim report January 2021 ACCC | LNG netback price series 2021 Grattan Institute (Tony Wood and Guy Dundas) | Flame Out: the future of natural gas, November 2020