The International Energy Agency (IEA) released its World Energy Outlook (WEO) 2020 on 13 November. Much attention has focused on the fact that, for the first time, it included modelling of a pathway to net zero emissions globally by 2050 (termed the NZE2050 scenario). In total the report considers four scenarios described below.

It also considers the impacts of COVID-19. The pandemic and its consequential lockdowns have had a significant impact on energy demand globally which is set to be 5% lower in 2020 than the previous year. Energy investment plummeted by nearly a fifth, particularly investment in new oil and gas supply. The short-term impacts of the global pandemic are built into each of the WEO’s energy scenarios. Another new scenario, Delayed Recovery (DRS), considers a longer-term depression in energy demand caused by a slower return to economic growth. The DRS and NZE2050 mark a departure from the IEA’s traditional focus on policy settings as the driver of different energy futures.

In this article we examine what these findings mean for Australia’s renewable energy pipeline and the potential of a gas-led recovery.

Without new policy support solar, renewables and storage dominate the global energy landscape

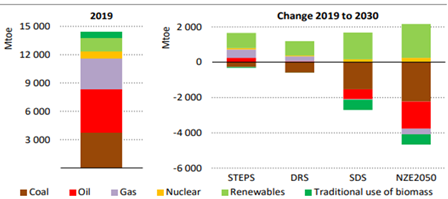

Under all scenarios, renewables continue to grow, displacing coal generation which peaks globally by 2030. In the Sustainable Development Scenario (SDS), oil also peaks by 2030. In the net zero by 2050 scenario (NZE2050), natural gas begins to decline by this 2030 (Table 1, Figure 1.)

Table 1: Policies modelled in the IEA WEO 2020 and implications for ‘peak fossil fuel’

|

Scenario |

Policy framework |

Fossil fuel peak by 2030 |

|

Stated Policy (STEPS) and Delayed Recovery (DRS) |

Existing policies and targets (COVID recovery in 2021 or 2023) |

Coal |

|

Sustainable Development (SDS) |

Paris well below 2oC[1], net zero 2070 |

Coal and oil |

|

Net zero by 2050 (NZE2050) |

Paris 1.5oC, net zero 2050 |

Coal, oil and natural gas |

Figure 1: Total primary energy demand by fuel and scenario (Figure 1.1, IEA WEO 2020)

The IEA’s Stated Policy Scenario (STEPS) is based on countries’ current policies and pledges (typically articulated in their Nationally Determined Contributions or NDCs as required under the Paris Agreement) and represents the least ambitious rate of transition to clean energy. For the first time, the STEPS scenario projects renewable energies will make up 80% of the growth in global electricity demand to 2030, overtaking coal as the largest source of electricity generation in 2025. This rapid advance of intermittent power will require robust grids and storage to ensure flexible operation across timescales from seconds to months. As a consequence, the IEA expects investment in transmission and distribution lines worldwide under the STEPS scenario will be 80% larger compared to the previous decade, and investment in battery storage to increase twenty-fold by 2030. Certainly Energetics continues to analyse domestic investment in battery storage and tracks increases on our website and sees indications of these trends.

Short-term evidence in support of the resilience of renewables investment is also provided by IEA Renewables 2020 Analysis and forecast to 2025. Market dynamics are analysed to demonstrate that new additions of renewable power capacity worldwide will increase to a record level of almost 200 gigawatts this year, with stronger growth of 10% additional renewable capacity next year. As a result, total wind and solar PV capacity is on course to surpass natural gas in 2023 and coal in 2024. In our PPA tracker we have seen installation of around 3,600MW in 2020 in Australia, which is over a 400% increase on last year.

Will Australia experience a gas-led recovery or a shift to net zero?

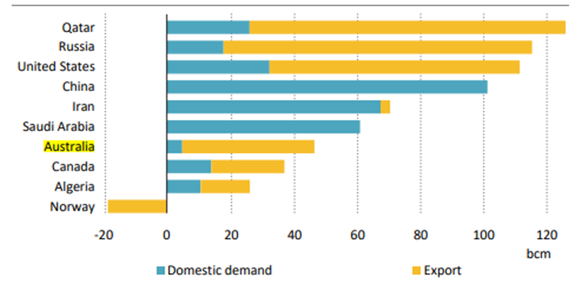

While natural gas production is resilient under the STEPS to 2030, this demand is mainly driven by South and East Asia, where it is required to support manufacturing growth and improve air quality by replacing coal-fired generation. Figure 2 clearly shows that the bulk of Australia’s gas production growth will go to exports. Australia’s domestic gas demand for manufacturing and other business and household purposes contributes the smallest amount of any of today’s ten largest producers.

Under the more ambitious Sustainable Development Scenario (SDS) a transformation would take place whereby nearly a quarter of all natural gas supply investment to 2040 would be directed towards hydrogen and bio-methane (increasing from around 1% today).

Figure 2: Changes in natural gas production for today’s ten-largest producers under STEPS (Figure 7.15, IEA WEO 2020)

Post COVID-19, Energetics sees opportunities and risks to the clean energy transition (Table 2). The economic recovery following the pandemic has created an environment where low interest rates, accelerated depreciation and fiscal stimulus will assist the capital-intensive nature of clean energy technologies. On the other hand, the uncertain policy environment and lower cost of oil and gas present significant challenges to renewables projects.

Table 2: Opportunities and risks of the pandemic to the clean energy transition

|

Opportunities |

Risks |

|

Low interest rates, accelerated depreciation and fiscal stimulus may mean the capital-intensive nature of clean energy technologies could translate to lower deployment costs |

Continuation of low oil and gas prices will reduce payback periods on electrification and clean energy projects that consume oil and gas |

|

Financial pressures relating to programs to reduce the emissions intensity of financed assets on existing coal, and increasingly gas assets could accelerate retirement and increase the difficulty of financing new projects |

Asset impairments may prolong operation if they enable coal and gas assets to maintain required rate of return |

|

Low fossil fuel prices and reduced transport use due to telecommuting could make it easier for governments to reform fossil fuel subsidies. |

Increased telecommuting may slow progress towards zero emissions vehicle adoption if urban air quality improves and cars “age” slower |

Are you being left behind on the road to net zero by 2050?

Energetics believes the new NZE2050 scenario gives an insight into what the future may look like as increasingly large portions of the global economy fall under net zero commitments. Businesses need to consider why they are not setting a target and evaluate the risks and opportunities of others’ net zero ambitions impacting their supply chains, operations and demand for products. To avoid being left behind, business should pursue capital investment in projects that cost effectively reduce operational emissions and generate momentum towards more ambitious targets and emission reductions.

Energetics can support you in the development of your net zero emissions target and pathway to its achievement. Please contact us or visit our Net zero emissions: pathways and opportunities knowledge centre.

For more information you can also check out the IEA’s executive summary or purchase the full report to view online: World Energy Outlook 2020.

Footnote

[1] 1.65C