In the past, the overwhelming majority of large commercial and industrial electricity consumers chose to hand the management of electricity market risks to their electricity retailers. The typical retail services agreement was a fixed price forward contract with some volume flexibility over the contract term. When wholesale futures contract prices were low and flat (around $35-$40 per MWh) such arrangements provided the most appropriate means of transferring risk for most end-users. After all, quantifying, managing and hedging volume and price risk is core business to energy retailers.

Today we see a very different landscape. With futures contract prices more than doubling across all market jurisdictions in the National Electricity Market (NEM) large customers have been reviewing their position and questioning the appropriateness of this simple risk transfer. More and more large electricity users are seeking to take back control and manage the cost of the retail energy component of their electricity bill differently. In doing so they need to weigh up the options against their business’ risk profile and make risk/reward trade-offs.

In this article we look at the role corporate renewable power purchase agreements (PPAs)[1] can play in hedging against retail electricity price risks.

Mitigating price and volatility risks over the long term[2]

Consider the potential value of a corporate PPA to an end-user willing to source 20% of its load through a bundled supply arrangement from a renewable energy project providing power as well as Large-scale Generation Certificates (LGCs). Let’s also include the cost of load balancing services from a retailer.

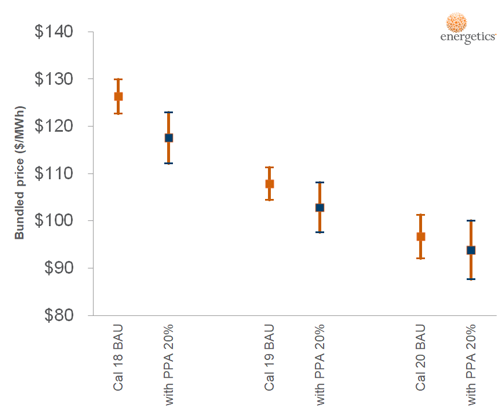

We then compare this retail PPA to the price of a business-as-usual retail arrangement, under which the price is based on a wholesale futures contract, retail contract premium and LGC pass-through charges. The following chart provides an indicative comparison over calendar years 2018 to 2020.

Figure 1: Comparative analysis of retail contract with and without a renewable energy PPA

What we see from the comparison is that a PPA contract provides lower overall bundled prices. Across the three calendar years, the expected benefit narrows because of the current reduction in wholesale futures contract prices (base futures contract at $75 per MWh for delivery in 2020 vs $105 per MWh for 2018 in Victoria) and the expected reduction in the large-scale generation certificates (LGCs) pass-through charges applied by retailers in 2020[3].

Beyond its medium term attractiveness, a renewable energy power purchase agreement provides a long term hedge, with partially fixed or indexed prices for 10 years being typical. This is a much longer term than the conventional hedging strategy, which relies on entering into a fixed price forward contract with a retailer for the next two to three years. Electricity markets are not known for their liquidity and there is limited opportunity to secure a retail contract beyond a three year time horizon. Across all market jurisdictions in the NEM and across all exchange-traded futures products (base load strips, peak period strips), contracts are very thinly traded beyond two years.

The advantage of using a corporate renewable energy PPA as a hedge therefore lies in reducing long term volatility risk and removing the need to incur a liquidity risk premium and transaction costs on futures or forward contracts.

Renewable energy PPAs reduce the cost of green certificates

Under the Large-scale Renewable Energy Target scheme, wholesale purchasers of electricity, mainly electricity retailers, buy LGCs to meet their renewable energy obligations. The number of certificates each liable entity needs to source and then surrender is based on the Renewable Power Percentage (RPP) as set by the Clean Energy Regulator in each year, and applied to the amount of electricity acquired. This percentage is expected to increase from 14.22% in 2017 to around 20% by 2020. Currently these certificates are traded at around $85 by energy commodity trading firms. Retailers’ offers to corporations for calendar year 2020 contracts include certificate prices at around $70 per certificate, leading to an expected additional $14 per MWh delivered.

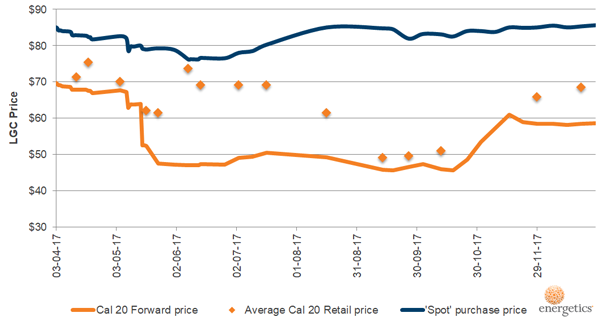

The following chart shows the distinct price difference between LGC prices offered by retailers[4] for calendar year 2020 compared to the prices of separate forward contracts for LGC supply.

Figure 2: LGC pass-through charges vs LGC forward contract prices

This material price difference (more than $10 per certificate on average over the nine month period of analysis) explains why an increasing number of corporations are looking into acquiring LGCs themselves, rather than bundling the purchase of certificates with a two or three year retail services agreement with their electricity retailer.

In addition, the bankability of a renewable energy project is influenced by the extent to which the project developer can secure firm pricing for both the power and LGC ‘commodities’. The attractiveness of a bundled deal is such that a renewable energy project will typically sell bundled LGCs at a $10 to $20 discount compared to the price for LGCs where only LGCs are bought (known as an ‘unbundled offtake’). As a result, when buying LGCs together with electricity via a renewable energy PPA, a corporation receives the benefit of the discount which is at a much lower cost than the environmental pass-through charges applied by retailers.

Beyond this ability to reduce the cost of mandatory LGCs, some corporations in Australia contract for a larger proportion of their load and get LGCs over and above the RPP requirements. Why? The objective is to leverage the green premium of the renewable energy project and secure a long term supply of high-quality voluntary carbon abatement permits to meet a greenhouse gas emissions target or trajectory. Some large end-users, especially Australian real estate investment trusts, also want to meet NABERS rating targets and source GreenPower through a PPA contract. They seek to contract with projects carrying a GreenPower Connect accreditation.

When assessing the value and options around corporate PPAs your business should also consider its climate change strategic intent. The treatment of LGCs and the value ascribed to these commodities needs to be clearly understood upfront taking into account the National Carbon Offsets Standard (NCOS). Your climate change strategy will impact decisions around the offtake volume and commercial terms you need to secure from a renewable energy PPA contract.

Clarify your risk capacity and appetite

In order to manage your electricity market and climate change risk exposure, there are a number of renewable energy PPA contracting and pricing arrangements. The model you choose needs to align with your business ’ risk profile, noting that there is not a single, well-accepted PPA model that can cover all end-users’ goals, risk capacity and risk appetite.

The following risks deserve special attention:

- Partial spot market exposure, especially the ability to deal with the lack of predictability of an annual energy budget and the capacity to alter consumption in response to market prices.

- Additional corporate obligations, such as hedge accounting treatment (hedge effectiveness testing) and the possible need to get an Australian Financial Services Licence if entering into an energy derivative contract.

- Changes in law, especially around the LRET and possible impact on the value of environmental tradeable certificates over a long term PPA contract.

When conducting a risk review, you will need to gauge your ability to implement and manage controls that can mitigate such risks, noting that there are many ways to reduce, transfer or avoid these and other risks.

Formulate your renewable PPA preferred model

Once options, risk capacity and risk appetite are well defined, your business has the basis upon which an informed decision can be made on the optimal level of risk to take, the preferred renewable energy PPA contract model and pricing model.

In instances where corporations want to remove some of the volatility from their electricity costs, they can enter into a long-term ‘physical’ PPA, which involves price firming by a retailer and integration, one way or another, of the renewable energy generation output into their retail services agreement[5].

Others, recognising the complexity of such tri-partite arrangements and likely additional contract premium, are prepared to enter directly into a long-term ‘financial’ PPA, which uses revenue from the spot market as a hedging instrument to offset changes to retail energy costs.

The following table summarises the risk/reward trade-off.

|

PPA model |

Key benefit |

Key risk |

|

Enter into a financial PPA (derivative contract) to mitigate impact of shocks to energy prices |

Low PPA rate and transaction costs |

Partial hedge – needs active risk management |

|

Enter in a retail ‘physical’ PPA to remove some of the volatility from energy spend |

Firmer price with load balancing at retail rates |

Market for sleeving services by retailer is still under-developed - comes at a cost but preserves upside potential while eliminating downside risk |

It is critical to understand how effective a renewable energy PPA arrangement can be in hedging your corporation’s future electricity prices. The locational basis risk and the effectiveness of the hedge, i.e. the strength of the correlation between the price of your electricity supply and the price of a PPA contract, are two key elements to assess. Energetics can advise on how these factors can apply to the contracting structure and pricing arrangement your business pursues.

Finding the right risk-reward trade-off for your business

Over the last couple of years, Energetics has been approached by a number of corporations seeking advice on the attractiveness of a PPA price offer by a renewable energy developer. Every time we had to broaden the discussion beyond price, as the best PPA solution depends on both the proposed price and the level of risk tolerance within an organisation. The greater the aversion to risk the more the optimal approach moves from managing wholesale pass-through to transitioning to forward contracts on the retail side; and from a financial hedge to a retail ‘physical’ PPA on the renewable energy supply side.

By taking an integrated approach to managing risk, understanding the needs of the organisations involved and the range of contracting options available, Energetics has been successful in securing both financial and retail ‘physical’ PPA arrangements. Please contact us if you would like to understand more about where the opportunities may lie for your organisation.

References

[1] Power purchase agreement with a utility-scale, in front-of-the-meter, renewable energy generator (solar farm, wind farm, energy-from-waste power plant)

[2] Consider as well your business ability and economic rationale to implement energy efficiency projects, on-site generation capacity and demand response capabilities

[3] The expected reduction in pass-through charges in 2020 is in line with forward projections for this green commodity

[4] Based on a sample of retail offers received by Energetics over the last nine months. Prices are averages of offers received. “Spot” prices represent actual trades for immediate delivery as reported by energy commodity trading firms

[5] E.g. price reset mechanism, back-to-back electricity swap agreement