Globally, decarbonisation and net zero commitments are expected to increase demand for carbon offsets. The Taskforce on Scaling Voluntary Carbon Markets (TSVCM) estimates that to reach Paris targets, demand for carbon credits could increase by approximately 15-fold to 1.5 - 2 gigatonnes of carbon credits per year by 2030[1].

At the same time, with escalating scrutiny over net zero claims, there are growing market expectations for genuine emissions abatement to be prioritised over the purchase of offsets; and for offsets to only be deployed for hard to abate ‘residual’ emissions. Furthermore, organisations are being encouraged to pivot towards ‘removal offsets’ (as opposed to ‘emissions avoidance-based offsets’)[2], based on the IPCC’s recent findings that removal offsets are critical for achieving net zero by 2050[3].I

As previously highlighted by Energetics[4], not all offsets are created equal, and without a rigorous selection process to ascertain offset quality, their use can potentially expose organisations to a new set of risks, including ‘greenwashing’. As such, companies need to proceed with caution and conduct offset quality due diligence with respect to attributes such as additionality, permanence, vintage, location, verification standards and social value benefits.

In this article we discuss the importance of managing an array of risks when procuring offsets.

What has changed in Australia’s carbon markets?

Australian Carbon Credit Unit (ACCU) prices have experienced a period characterised by both high prices and volatility, rising to almost $60/tCO2-e in January 2022 (compared to circa $20/tCO2-e at the same time in 2021)[5]. Whilst there is ongoing policy uncertainty, in light of the current review of the Emissions Reduction Fund (ERF) and changes to the Safeguard Mechanism[6], there is a general consensus that higher prices will prevail into 2030 and beyond. As such, in shaping their offset procurement strategy, organisations need to contemplate much higher and more volatile prices to mitigate financial risks.

In working with our clients to support their decarbonisation pathways, we are seeing greater selectivity about the type of offsets they want to consider as they try to balance corporate objectives, offset costs, risk tolerance and credibility imperatives.

Whilst traditionally a large number of organisations would have opted for an over the counter (OTC) procurement option (given its low complexity), increasingly we see the market pivot towards risk-managed approaches, including structured carbon hedging options, which allow for greater benefit and risk sharing between offset providers and corporate buyers. Australian corporates are also increasingly interested in being involved in offset projects themselves (either as investors or offtakers), to ensure alignment with their broader ESG objectives. Particularly for projects offering ‘co-benefits’ such as biodiversity and community benefits.

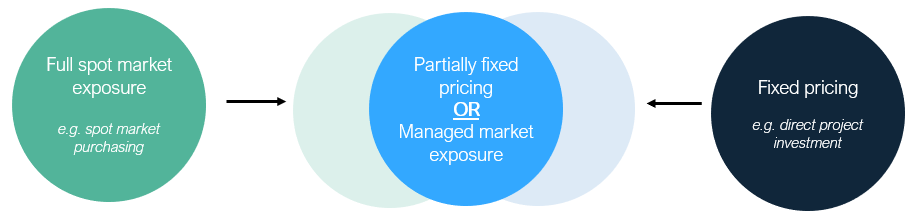

This trend has driven the emergence of a wide range of procurement contract and pricing models (see Figure 1) with different levels of market price exposure and counterparty risks. The choice of a procurement model and associated offset types is also influenced by any policy or program requirements that a company may want to comply with. For instance, from July 2023, Climate Active organisations with a footprint greater than 1,000 tonnes CO2-e need to procure a minimum of 20% ACCUs to support their accreditation[7]; further, there is speculation about stricter vintage requirements for offsets through a rolling five-year vintage rule[8]. If this was to be implemented, Climate Active certified companies would not be able to bulk-purchase offsets upfront for periods longer than five years, meaning that implementation of long-term procurement strategies would become ever more important.

Figure 1: Carbon offset procurement options

Long term price risk management

Risk management procurement models currently available in the market range from progressively purchasing offsets through a broker, to securing a long-term fixed price offtake from a new ACCU generating project. The selection of the appropriate procurement approach needs to be driven by a clear understanding of market price risk within the contract model, and its alignment with the organisation’s risk tolerance. While progressive purchasing allows organisations to ‘average’ the market over time and take advantage of favourable market conditions, a long-term offtake provides cost certainty. Both approaches have drawbacks: when purchasing progressively, any price increases will hit the organisation’s balance sheet, but locking in prices for the long-term means it is not possible to take advantage of a falling market if it were to occur.

A proactive approach to procurement can mitigate carbon costs

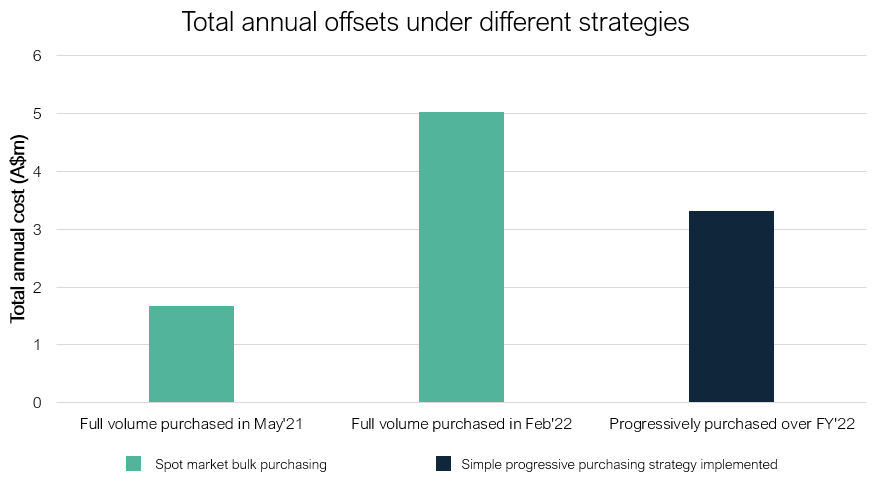

Figure 2 illustrates time-to-market risk using the offset requirements for a large Australian organisation. ACCU prices increased almost 300% over the second half of 2021, before losing nearly half their value in the first quarter of 2022. In the example below, this movement could have resulted in a A$3.4m cost differential driven by the timing of the purchase.

Applying a simple progressive purchasing strategy would have allowed the organisation to average the market, taking away some of the guesswork. In the figure below, purchasing an equal number of offsets each month across FY22 could have saved the organisation A$1.7m compared with buying at the top of the market. A well-designed strategy, which includes solid governance principles, based on a deep understanding of the market could have delivered even greater savings.

Figure 2: Illustrative example of annual offset cost depending on procurement approach

What else should be considered?

Emissions forecast certainty

Organisations with variable emissions profiles, including those who are investing in on-site emissions reduction initiatives, may find it less beneficial to invest in a project which provides the same number of offsets year on year. The level of confidence in emissions forecasting should also be considered. If there is significant uncertainty regarding an organisation’s emissions profile, fixed volume models may not be optimal and market-based procurement or risk sharing with an offsets aggregator may be a better option.

Exposure to bespoke risks

Procuring carbon offsets directly from a project provides buyers with optionality and brand benefits. However, it may also expose an organisation to a range of unfamiliar risks, such as counterparty risk, project delay risk or ‘change-in-law’ risk. Procurement model selection impacts the level of exposure to these risks. For instance, an organisation choosing to manage its costs by directly investing in an offset-generating project may be left exposed if changes to the ACCU scheme make the project unviable (depending on the stage of investment and ERF application status). Additionally, the technical expertise and capability of the project developer and/or operator may also be a concern under some contracting models, where the buyer is exposed to project performance risk. Appropriate due diligence and assessment processes should be put in place when entering long-term offsets procurement agreements to quantify and minimise exposure to these risks.

Co-benefits

Many projects available in the market provide additional benefits to local communities or the environment. Possible co-benefits may include community development initiatives, gender equality programs, Aboriginal and Torres Strait Islander employment opportunities, or biodiversity protection schemes. It is important to note that certain co-benefits may result in higher price premiums. For example, ACCUs generated by savannah burning projects generally attract a premium, sometimes as high as 100% compared to the cheapest available alternatives. This is driven by the high desirability of such projects due to their environmental and social co-benefits. However even project types, which are not generally associated with a price premium, may provide additional benefits, so buyers would be well-advised to pay close attention to the cost/benefit balance.

Procurement strategies, which facilitate clear project linkage, such as direct project investment or long-term offtake contracts, allow organisations to maximise the value gained from partnering with projects that offer co-benefits aligned with the organisation’s long term ESG goals.

The features of an effective procurement strategy

Aligning an approach to sourcing carbon offsets with the specific requirements of your organisation along with its broader ESG objectives and risk appetite is essential. An effective procurement strategy needs to balance these corporate drivers with commercial and environmental imperatives and takes into account:

-

Decarbonisation targets and any increase in ambition over time (e.g. inclusion of scope 3), which may impact future liability and offset requirements

-

Appropriate expertise to manage the typical and bespoke risks throughout the tender process, as well as over the life of the procurement

-

Requirements for practical day-to-day management of different types of offtake, and internal availability of resources

-

Opportunities to create social and environmental value through offsets with associated co-benefits

-

Any ability for the business to generate offsets either directly or through collaboration with supply chain partners and/or customers

-

The rapidly changing and evolving offset market, future pricing scenarios and any ‘shock’ events (e.g. significant policy changes), which warrant a strategy refresh

-

Emerging guidelines, such as the ‘Core Carbon Principles’[9], which are expected to establish a consistent and standardised approach for assessing carbon credits.

Energetics’ carbon markets experts can help your business understand the risks and identify the opportunities.

Energetics is well positioned to partner with you to inform and shape your carbon offset strategy and market engagement approach, including:

-

identifying the role of offsets in your net zero pathways

-

ACCU price scenario modelling

-

developing a carbon offset strategy, including offset selection and evaluation; and

-

managing risks through a robust procurement process that balances credibility, market risks and costs.

Energetics AFSL #329935. Our AFSL enables us to provide market advice and recommendations related to electricity derivative products and Australian carbon credit units (ACCUs).

[1] Taskforce on Scaling Voluntary Carbon Markets | Final report (2021)

[2] University of Oxford | The Oxford Principles for Net Zero Aligned Carbon Offsetting (2020)

[3] IPCC | Climate Change 2022: Mitigation of Climate Change (Summary for policymakers)

[4] Energetics | How can I be sure that I am buying a high quality offset? (2022)

[5] Clean Energy Regulator | Australian carbon credit units (ACCUs)

[6] Energetics | Safeguard Mechanism reforms: Consultation on draft legislation (2022)

[8] Climate Change Authority | Review of international offsets

[9] Norton Rose Fulbright | Scaling voluntary carbon markets: International taskforce seeks input from private sector