For some companies, listed or unlisted, developing a strategic and comprehensive response to climate change is a new undertaking. However, from January 2025, businesses across Australia must start to disclose their climate-related financial risks within company financial reports. Not only is it an Australian government requirement, the Australian Sustainability Reporting Standards (ASRS) is just the latest in a series of climate disclosure requirements to be established in jurisdictions across the world under the umbrella of the International Financial Reporting Standards (IFRS) and specifically its International Sustainability Standards Board (ISSB).

On this page you will find the resources and insights you need to get started.

ERM Energetics has deep expertise developed over years of climate risk and net zero advisory experience – from capturing and managing relevant data, to building an inventory of greenhouse gas emissions, setting a strategy and targets for decarbonisation, identifying and managing your climate risks (and opportunities), and putting together a report on the outcomes that has been assured to the level required under ASRS for your company size.

Time is tight, and the scope is broad and complex. We can help.

Important information and insights

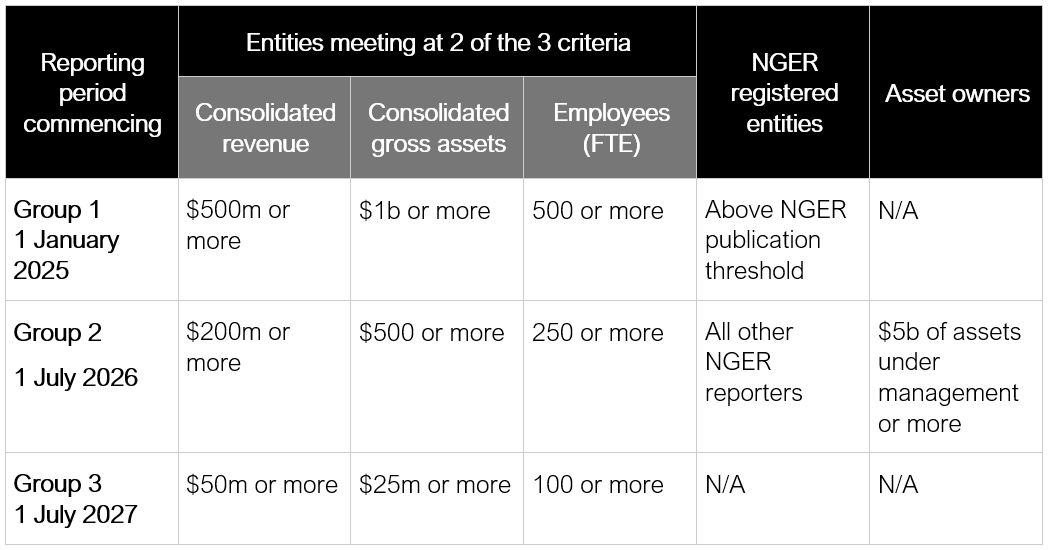

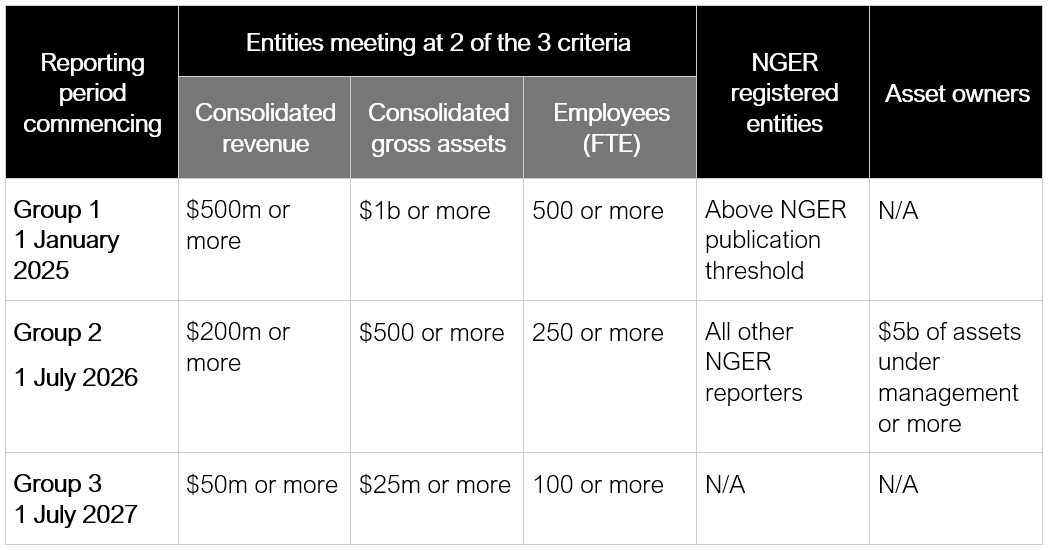

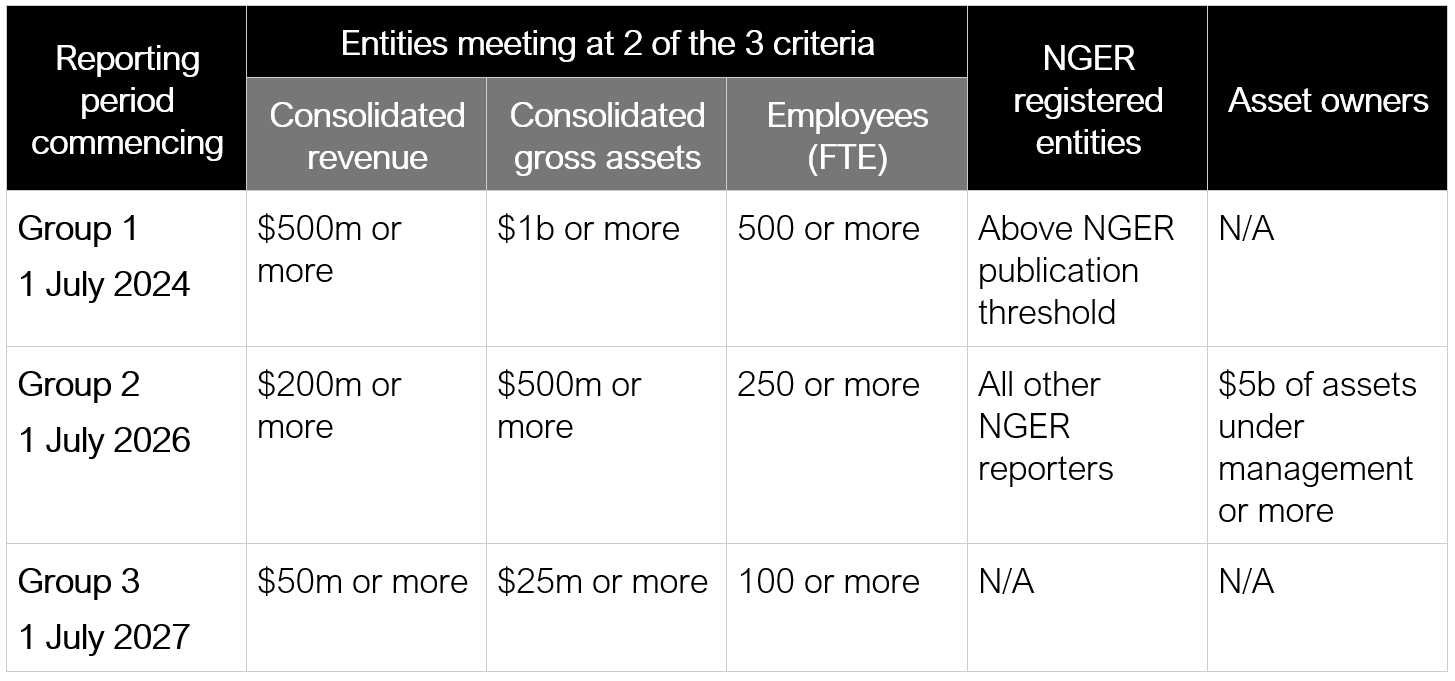

Implementation will be phased according to the thresholds shown in the chart. Both listed and unlisted entities that meet these criteria fall within the scope of mandatory climate disclosures.

Phased in approach: beginning on or after

Phased in approach: beginning on or after

Potential assurance pathway

Insight: what is your disclosure ‘appetite’? Not every company will be the same. Some say, “please help us to nudge our chin over the bar”. Others want to be a leader in sustainability disclosures. Each organisation needs that level-setting conversation to understand how they wish to use the three year phasing period and decide the approach that makes sense for their business.

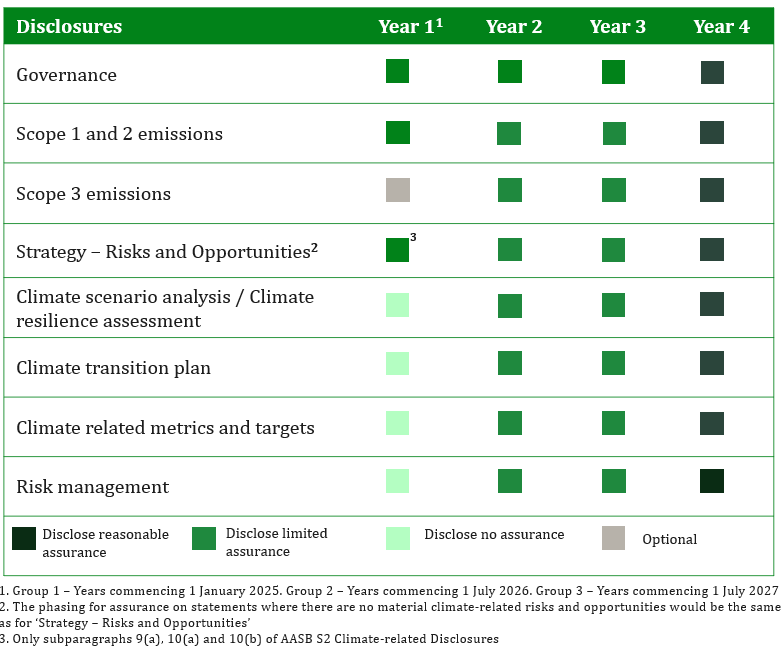

Companies need to disclose against requirements relating to climate governance throughout the company, climate risk (physical and transition) and opportunities, emissions (scope 1 and 2 initially and scope 3 in the second year) and their transition plans including emissions reduction targets, metrics and how the businesses strategy is informed by climate-related matters.

The requirements increase over time. For instance, initially qualitative assessments are allowed for climate risk, but these move to quantitative by end state.

Also, the level of assurance also increases over time.

Captured companies need to include a range of disclosures in a sustainability report within their annual reporting suite. Example content below:

- Governance

- Links to remuneration

- Requirements for how Boards determine whether/how responsible entities have appropriate climate competencies

- Strategy

- Transition plans, including for achievement of emissions targets

- Role of carbon offsets in meeting targets

- Progress against transition plan, including capital allocation

- Resilience of business model as considered through scenario analysis (may be qualitative in first year, quantitative from later years) under at least two climate futures (1.5oC and 2.5oC+)

- Risks and opportunities

- Identification and assessment of climate-related risks and opportunities

- Disclosure on how climate-related opportunities are managed and integrated

- Disclosure on the effects of climate risks and opportunities on the following: business model and value chain, strategy and decision-making, financial position, financial performance, and cash flows (quantitative, with some exceptions)

- Metrics and targets

- Scope 1 and 2 emissions for first reporting year; material Scope 3 emissions from second year

- Disclosure of decarbonisation plans and their operationalisation

- The above to be based on NGER (National Greenhouse and Energy Reporting scheme) where applicable (ERM Energetics has advised NGER reporters since the scheme’s inception.)

Insight: ASRS requires only financially material information. This is not quite the same as “disclosure only of financially material risks”. The question of where financial materiality ends requires agreement across sustainability and finance risk, legal and strategy functions. Bridging the divide between the sustainability paradigm and the finance paradigm isn’t easy but will strengthen both.

Anything that’s not financially material (too fluffy or too small to matter) can be excluded from the disclosure process. But if climate risks and opportunities are financially material you will need to have very robust approaches in place not just to understand and disclose them but to address them.

Disclosures are due at the same time as financial reports and are contained within a Sustainability Report. In Australia, for the majority of Group 1 reporting companies, this will be the end of September 2026.

Insight: The core of your disclosure depends on an iterative process of progressively more sophisticated risk and opportunity analysis. Your response to requires a thorough understanding of climate-related risks and opportunities, not just to your operations but upstream and downstream as well. You need to understand where your risks are concentrated across your business model and value chain, over three strategic timeframes. You need to define metrics to track these risks and your performance against them. You don’t need – but you will want – to define actions to reduce your risks and capture value from the opportunities. You don’t need to – but you may as well – roll these actions into a coherent strategy and call it a transition plan. And then you need to make a claim about your entity’s resilience to these risks.

Your process will look a bit like this (noting that risk analysis should be sharpened within the annual process and over subsequent years):

While it's mandated, remember a climate-related financial disclosure provides the insights that your investors want. Prepare the information well and you will understand where your company needs to be in a carbon free, climate-impacted world. There's also huge opportunity. This is about ensuring the long term investability and sustainability of your business.

Insight: Start with the end in mind. You need a compliant disclosure - that goes without saying - but disclosure is a tool to drive a business's response to climate change and its work to achieve net zero emissions. Disclosure can start new conversations - engaging customers, investors, suppliers and other stakeholders in your climate response, rather than just being a tick box exercise.

What does readiness look like? Take our self assessment |

| Our anonymous ASRS survey takes ~5 minutes and will show where your business sits on a readiness maturity curve. You will also receive recommended next steps, tailored for the level achieved. Note, if your company reports in a different jurisdiction, an ISSB Readiness Assessment is also available via the link. |

Develop a roadmap for your business |

| Start to plan your response. ERM Energetics' climate strategy and reporting experts have created an interactive roadmap to disclosure-readiness, drawing on insights from our work with clients. Explore our roadmap or reach out to one of our experts for support and guidance in developing of your own. |

Related insights

-

Mandatory climate reporting Mandatory climate reporting is here. How ready are businesses to meet their obli…READ MORE -

Podcast What must you disclose in mandatory climate reporting? What is ‘material’?READ MORE -

Mandatory climate reporting Climate-related financial disclosures need assurance: ‘limited’ then ‘reasonable…READ MORE -

Mandatory climate reporting Climate scenario analysis – a guide for finance professionalsREAD MORE -

Physical risk analysis Climate disclosures should be assessed against the first National Climate Risk A…READ MORE -

Physical risk analysis Navigating uncertainty: drawing value from credible physical risk analysisREAD MORE