On the 23rd of October, the Australian Accounting Standards Board (AASB) released the Exposure Drafts of two new Australian Sustainability Reporting Standards (ASRS) for the disclosure of climate-related financial information.

The ASRS were derived from the two International Sustainability Standards Board (ISSB) standards released in June – International Financial Reporting Standards (IFRS)-S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS-S2 Climate-related Disclosures – and “Australianised” according to proposals and feedback provided through a consultation process run by Treasury earlier this year.

The new ASRS take us one step closer to phased implementation of mandatory climate-related reporting; this phasing will occur between 1 July 2024 and 1 July 2027. Treasury is anticipated to issue a final Position Paper' ahead of introducing the climate reporting legislation to Parliament in early 2024.

How does the ASRS compare with the IFRS guidance?

- Scope narrowed to climate-related information only: The draft ASRS 1 has been limited in scope to only financial information related to climate change. Other sustainability areas (eg. water or biodiversity) are not covered.

- Entities with no material climate-related risks still have to disclose: ASRS indicates that businesses must still disclose if they do not have any material climate-related risks or opportunities given this is still useful information. They must also disclose how they reached this conclusion.

- Industry-based disclosures are not required: Entities can choose to disclose industry-based metrics according to their Australian and New Zealand Standard Industrial Classification (ANZSIC), but this won’t be mandatory until AASB is satisfied that the ISSB’s industry-based disclosures have been made appropriate for Australia. Companies who choose to do this need to recognise that ISSB sector guidance is based on Sustainability Industry Codes which do not necessarily align with ANZSIC codes.

- Reporting periods for climate-related information must be consistent with financial reporting periods: Provisions in IFRS S1 for temporary differences between financial reporting periods and sustainability-related reporting period have been omitted from ASRS 1. The AASB notes that the provisions had caused confusion.

The AASB is seeking feedback on the following items:

- Requirement for two scenarios, including a Paris-aligned scenario: The draft ASRS 2 sets out a requirement for entities to analyse their climate resilience under at least two possible future states, one of which must be aligned with the 1.5°C target in the Paris Agreement. The ASRS does not specify an upper-temperature scenario. This is consistent with the approach proposed by Treasury but differs from the IFRS S2 which does not prescribe the number/type of scenarios.

- Entities must disclose executive remuneration details relating to climate: Consistent with the IFRS framework, the ASRS requires Australian entities to disclose whether or how climate-related considerations are factored into remuneration, and the percentage of executive management remuneration linked to climate-related considerations.

- Phased inclusion of market-based scope 2 reporting after year 3: Consistent with the Treasury proposal, ASRS 2 includes a phased approach to including market-based scope 2 emissions, as well as the requirement for location-based scope 2 emissions as set out by IFRS-S2. This is to provide end users with greater transparency as to the magnitude of net emissions and the quality/integrity of any certificates used.

- Some relief around scope 3 and financed emissions: The ASRS is less prescriptive about scope 3 and financed emissions disclosure than IFRS-S2 and introduces some points of flexibility. For example:

- Where data is not available for the reporting period, businesses can disclose scope 3 emissions using data from the immediately preceding period, as aligned with the Treasury consultation paper.

- The ASRS includes the 15 scope 3 categories from the Greenhouse Gases (GHG) Protocol as ‘examples to consider’ when disclosing scope 3 emissions, rather than requiring strict alignment with the categories under IFRS-S2.

- For entities with financed emissions, the ASRS also does not explicitly require the additional disclosure of disaggregated financed emissions as prescribed by the GHG protocol, but requires businesses to instead consider whether it applies to them.

- GHG emissions reporting largely aligned with NGER: GHG emissions classifications are aligned with IFRS-S2, which involves some minor deviations from NGER GHG classifications. Measurement and calculation methodologies are largely aligned with NGER.

- Carbon credits: Proposed expansion of the IFRS definition of a carbon credit to allow inclusion of non-Kyoto ACCUs.

What do Australian businesses need to do next?

As the details of the new mandatory climate disclosures regime firm up, Australian businesses, irrespective of their climate disclosure maturity, need to take a number of preliminary steps to ensure they are well positioned for future reporting.

Considering the short timeframe for implementation of ASRS disclosure requirements (July 1 2024-27), businesses should consider the following actions.

- Build internal understanding across relevant functions (ESG/sustainability, strategy and finance) of the new reporting regime, its mechanics and implications.

- Develop an understanding of climate-related scenario analysis, and the step-change between qualitative and quantitative analysis required to report on potential financial impacts: Treasury’s second consultation paper proposed a fairly rapid transition from qualitative to quantitative scenario. Due to expressed concerns about the significant capability and resource requirements for undertaking quantitative scenario analysis, particularly in the early stages of mandatory disclosure, the AASB decided not to specify a requirement for quantitative scenario analysis. However, the AASB indicates it expects entities to develop quantitative analysis capabilities as they strengthen their approach to climate-related scenario analysis over time.

- Investigate credible approaches for determining the impacts of climate-related risks and opportunities on financial performance: Entities must assess and disclose how their financial position has been and is expected to change (as either a single amount or a range of potential impact) given their strategy for managing climate-related risks and opportunities, including investment, resource allocation and disposal plans that will support the strategy. This is aligned with guidance for credible transition plans (eg. Transition Plan Taskforce (TPT) guidance) as detailed below.

- Understand what’s required for a credible transition plan: Transition planning goes well beyond setting a net zero target. The UK’s Transition Plan Taskforce is driving a significant uplift in expectations that companies plan for – and demonstrate they are contributing to – economy-wide decarbonisation. Under the ASRS, companies are expected to disclose detailed information about their climate transition plan, including evidence of resource allocation, direct and indirect mitigation efforts, transition risk, key assumptions and dependencies, use of carbon credits and progress against targets.

- Develop an action-oriented understanding of your value chain exposure: Current and future climate-related impacts across the value chain will need to be assessed and disclosed under ASRS. Australian businesses need to consider where the risks and opportunities are concentrated within their business model and value chain to ensure the alignment of their resilience strategy.

How can Energetics help?

Energetics is ideally positioned to work with you in understanding the mechanics of Australia’s mandatory climate reporting regime. We can work with your team to assess your current position, including the credibility of your climate strategy and transition plan (including the integrity of your scenario analysis and role of carbon offsets) and engage with your stakeholders to develop a ‘roadmap’ to ensure you are well positioned to manage compliance and more importantly climate risks.

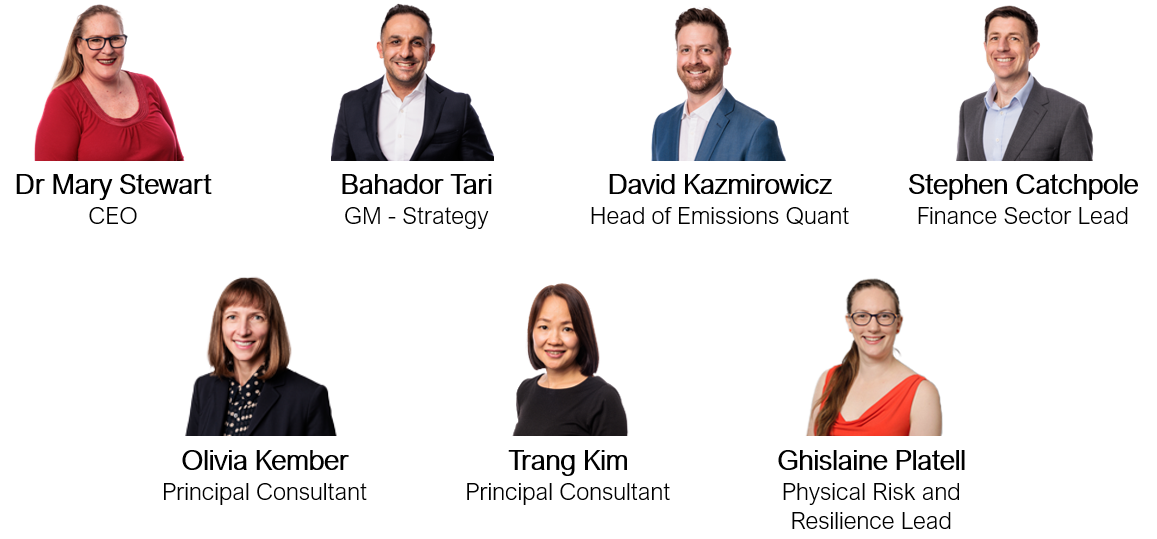

Our climate risk, transition and disclosure experts

Is your business ready for the implementation of a mandated climate-related financial disclosure framework?

Related insights

-

Mandatory climate disclosures | ISSB, IFRS Boards should see ISSB as an opportunity for sustained profit, not merely compli…READ MORE -

Mandatory climate disclosures | ISSB, IFRS Part 3: ISSB release standards and the Australian Treasury follows fastREAD MORE -

Mandatory climate disclosures | ISSB, IFRS Part 2: What will ISSB mean for Australian companies experienced in NGER reporti…READ MORE