Over the time that the National Electric Vehicle Strategy was open for consultation, the Australian Government could not ignore the calls for an Australian fuel efficiency standard to reduce overall tailpipe emissions. Considered long overdue, in February 2024 the Government announced that it will introduce a New Vehicle Efficiency Standard from 2025. Expected to increase demand and bring the price of EVs down, organisations operating vehicle fleets and working to achieve net zero targets should assess the opportunity ahead of this fundamental shift in the car market.

This article considers the breadth of issues for business – the risks and the potential new value to be captured, and the need to develop a comprehensive EV integration strategy.

The fuel switching challenges

Presumably, lower emission vehicles would simply be phased into our vehicle fleets as older models come to end-of-life. In many instances, when devising a net-zero strategy, a fleet transition (fuel switching) can be a highly effective way to reduce emissions on paper. However, there are complexities. Each organisation’s readiness will depend on their location and charging requirements (which are a function of how their vehicles are used). Further, there may be complexities around fleet lifecycles and supporting infrastructure lead times. Certainly a lack of charging stations and capacity in the electricity distribution network[1] can be a critical barrier to vehicle uptake.

Transitioning a company’s fleet to EVs requires structural, organisational and financial changes to business as usual (BAU)

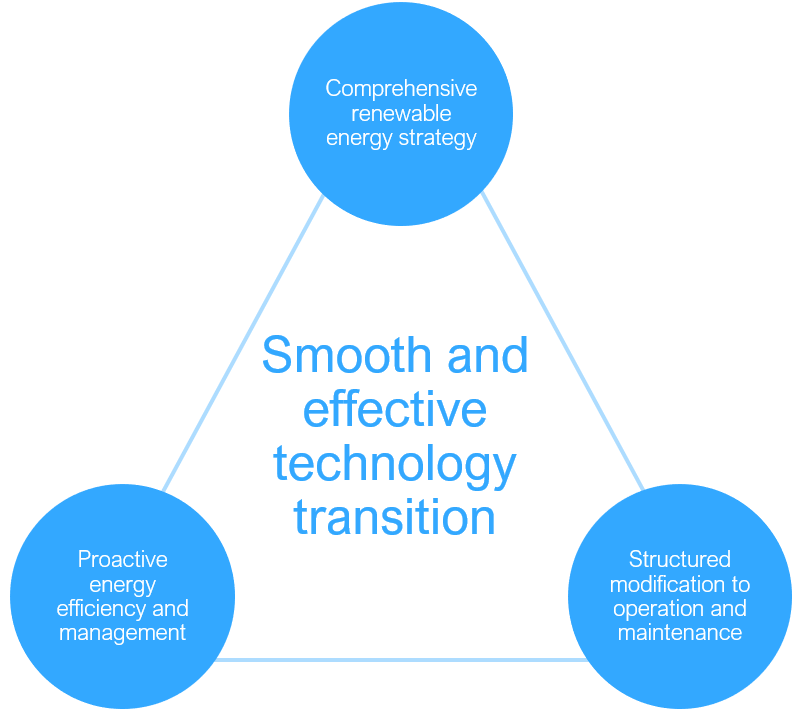

Figure 1 shows the EV ecosystem and the organisational functions that need to redefine their relationship with vehicles or supporting infrastructure, and expand their lines of communication to business functions not typical to their current operations.

Figure 1: The relationships around electric vehicles

The EV transition necessitates three main changes to an organisation’s BAU, summarised below in Table 1.

Table 1: Integrating EVs and three key areas of organisational change

|

Change in behaviour |

Change in operations |

Change in infrastructure |

|

A technology transition will always disrupt BAU. With this disruption comes the need to modify and manage behavioural changes for interactions with the new technology. This may include new or updated policies, safety standards, KPIs or department responsibilities, and new or redefined lines of communications between departments |

The shift from ICE vehicles to electric will require modifications to operations to account for the vehicle charging time. This can be managed through a detailed fleet management plan but will also see behavioural and infrastructure changes. Personnel will need to adapt to new operational standards, and infrastructure may need to be upgraded or specifically designed to support a critical operational need. Maintenance requirements will also need to be adjusted. |

The case for onsite charging is strong and includes considerations such as:

This will necessitate a change in on-site infrastructure to support the vehicle needs - with further implications for total electricity consumption and possible upgrades to upstream electrical distribution. |

While the change in operations is the link between personnel behaviour and the onsite infrastructure, the change in infrastructure is the key element of this transition. Therefore a reliance on a passive transition strategy will risk a disorderly, piecemeal, and ineffective transition which compromises operational capability.

Organisations with a large fleet or building portfolio, a need to manage charging onsite, or which require a fundamental change in operations as a result of the move to EVs, should take a proactive approach to the technology transition.

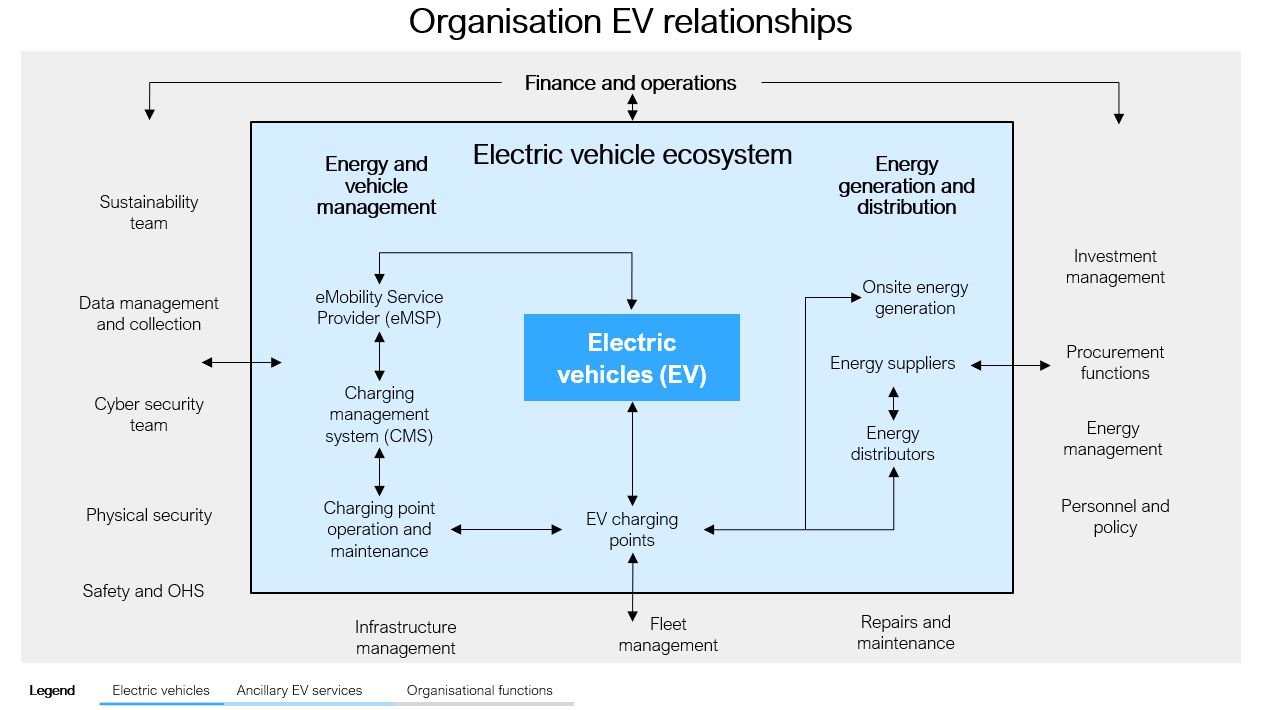

There are three areas that an organisation should pre-emptively address as shown in Figure 2.

Figure 2: Shaping a smooth and effective transition

A comprehensive renewable energy strategy

The transition away from liquid fuels to EVs increases electricity consumption. To ensure ‘tailpipe’ emissions are effectively zero, the electricity supplied must be from renewable sources - noting that with the decarbonisation of the grid, this challenge will decrease rapidly moving into the early 2030s. Notwithstanding this shift, a comprehensive electricity procurement strategy is needed as an unstructured approach and reliance on current retail agreements can introduce risks of exposure to supply and price volatility.

There are opportunities too. EVs and associated charging present a wealth of energy storage and demand management potential. With vehicle to grid technology (V2G) and communication protocols, self-managed charging infrastructure allows organisations greater flexibility in using the vehicle-based batteries as a distributed energy resource, as well as the ability to support grid needs and electrification demands through demand response or FCAS markets. This presents the opportunity to reduce the total cost of ownership and the associated cost of travel.

A robust and comprehensive renewable electricity strategy and retail supply agreement that addresses any risks associated with the increased load, the availability of market engagement opportunities, and any onsite generation or energy storage potential, will enable organisations to capitalise on the functionality and may capture additional revenue streams.

Proactive energy efficiency and management

EV charging loads require substantial additional electrical capacity. To manage the impact, there are benefits to pursuing energy efficiency activities - from minimising exposure to electricity market price volatility, to reducing the need to invest in electrical infrastructure upgrades, particularly costly and protracted grid integration. Finally, energy efficiency measures combined with effective charging management software can distribute your load requirements and minimise the additional electrical capacity needed across sites.

Also, a comprehensive energy efficiency program often leads to an increased level of understanding and awareness across an organisation which can see staff identifying efficiency opportunities – and therefore further reduce electricity consumption, emissions, and costs. Finally, proactive energy management can ensure that loads are distributed to take advantage of off peak, shoulder and negative price events and support engagement with demand response markets in the electricity grid.

Structured modifications to operations and maintenance

To ensure core operational activities can be continued, operational strategies and maintenance regimes will need to be modified. Finance, operations, infrastructure, fleet, safety and all the associated policies and directives that are managed through these departments will need to be engaged in the technology transition. The challenges include:

- Engaging with the array of charging stations and associated service providers

- Changing operations and maintenance associated with vehicles

- Modifying operations or infrastructure to support changes in vehicle availability or to maintain critical functions

- New skills and business functions to manage new challenges such as cyber security, maintenance and energy market engagement

- Transitioning funding allocations between fuel types

- Policies and processes for cost recovery

- Managing company vehicles or novated leases with the array of charging options for employees (eg home, public and business chargers)

- Accounting for emissions associated with company vehicles as these move from scope 1 emissions to scope 2 emissions

- Additional or changed training and onboarding.

If an as-needed approach is taken to these changes in operating conditions, confusion, ineffective or inefficient practices and the risk of delayed or compromised operations are dramatically increased. It is in the organisation’s best interests to identify and structure these changes early and ensure buy-in.

Capture the opportunity and create multiple benefits

While the requirements will be a challenge in many organisations, an effective electric vehicle and supporting infrastructure strategy will help to structure and define the new relationships, responsibilities and opportunities.

Energetics has been advising and supporting clients through technology transitions and changing policy environments for over 30 years. Transport decarbonisation involving fuel switching and changes in traction energy technology is the next evolution of technology transition.

We are specialists who understand the practical realities and uncertainties associated with emerging technologies and the rapidly changing policy environment. We can act as the independent umpire, supporting the development of a transition pathway best suited to your business.

[1] Australia’s current electricity distribution strategy is designed around centralised generation facilities with ‘poles and wires’ infrastructure transporting low voltage electricity to final users. This has deprioritised capital investment in the regions as historically, demand in these locations has been low. With the move to distributed energy resources and electrification, network providers are stretched to their technical limits with the availability of connection and capacity across the network. The industry is infrastructure intensive and therefore will require significant investment to prevent grid instability and support growth in an increasingly electrified economy.