2022 has been a very challenging year for large electricity and gas users. Whilst the first ever suspension of the National Electricity Market by the Australian Energy Market Operator (AEMO) in July averted widely mooted blackouts, prices remained stubbornly high on the electricity financial market ‒ well above historical averages – for the remainder of the year.

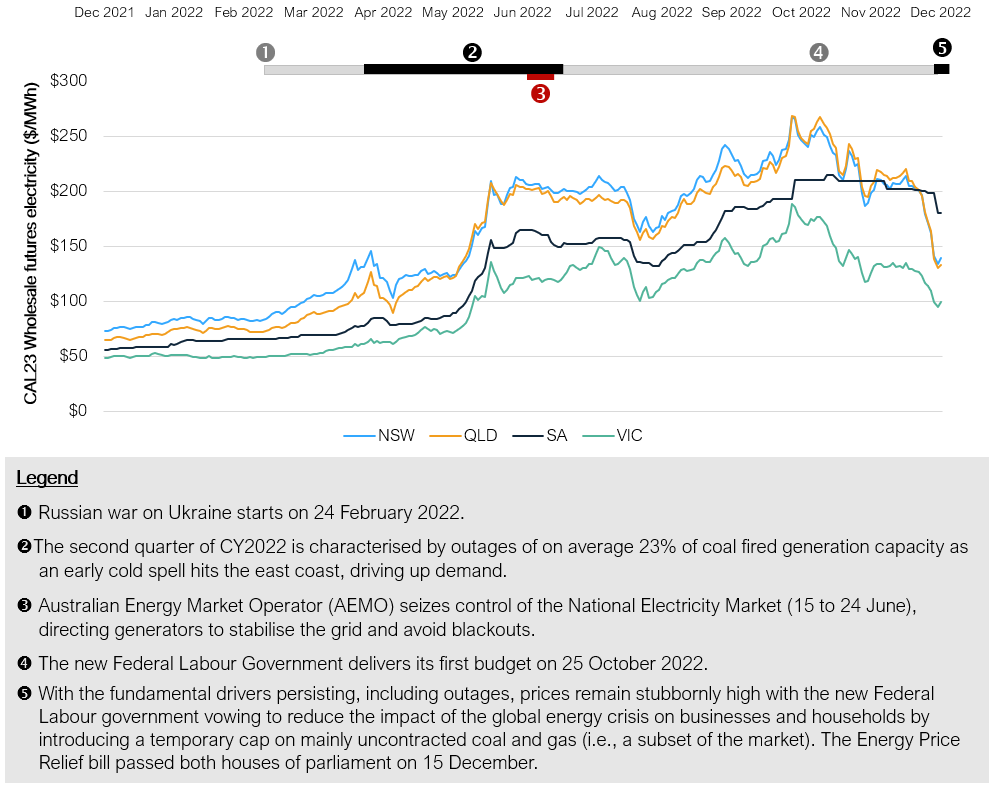

By way of example, as illustrated below with reference to CY23 electricity base futures market prices as at 14 December, expectations are that elevated prices will persist for some time to come. This should be no surprise as the ripple effects of the rally in international thermal coal and gas prices sparked by the war on Ukraine is still washing through the Australian economy, and outages at coal fired power generators in NSW, Victoria and Queensland continue to suppress supply.

Figure 1: Countdown to the unfolding energy market crisis

The federal Labour Party came to power in the midst of this crisis, following the May 2022 elections. Accelerating the energy transition away from (the still dominant) reliance on thermal generation, and driving down energy cost were central tenets of the Labour Party’s campaign. So, there was little surprise that the Federal Government when delivering its first Budget on 25 October signalled its intent to intervene, and that regulation was the preferred instrument – rather than cash handouts that could further fuel inflation that is already well above the Reserve Bank of Australia’s target range.

The Government acted relatively fast, but news of the intervention contemplated was leaked to the market a few weeks before the Energy Price Relief bill passed on 15 December. This contributed to a sharp decline in futures contract prices (as traded on the ASX Futures Exchange) since the start of December, but it also negatively impacted liquidity – particularly in the gas market – as suppliers awaited the official announcement, and then the passing of the bill.

Market response to the ‘Energy Price relief bill’

Given the timing of this article, Figure 1 above does not fully reflect the market’s forward view of the impact of the bill passing. However, it should be noted that the $12/GJ gas and $125/tonne black thermal coal price caps are only temporary (i.e., 12 months) and apply to a sub-set of wholesale supply. Ultimately, the impact on major suppliers could be limited as the caps for example exclude exports as well as pre-existing domestic wholesale contractual arrangements (i.e. where suppliers have already hedged their risks through long term contracts). Capping the input cost of some uncontracted thermal generators will apply a deflationary pressure on the merit order curve, hence the direct impact we have seen on the price forward curve in the power markets. This will in turn reduce the benchmark hedging cost used to derive the default market offer (DMO) prices in the mass market, a key focus area of the Federal Government, noting that this impact will be limited for the 1st of July 2023 DMO reset. For large end-users, the material price suppression on the exchange is a welcome shift allowing businesses to close unhedged positions by following the market down.

Given the pace with which this legislation has been formulated, the gas industry has been very vocal about the lack of consultation. They criticise the government policy position, advocating for policy settings that would stimulate supply of gas to drive down cost, rather than price caps which could negatively impact investments in new gas fields. With the retirement of the ageing coal-fired power generation fleet, delays in the build out of new renewable energy projects firmed by storage capacity, including Snowy 2.0, the question remains whether we will need further support from gas power generation over the coming years to meet our reliability of power supply standards. However, this must be considered in the context of medium-term supply and demand balance, in relation to our goal to limit a global warming to less than a 1.5oC increase, which would cast doubt over investment pathways reliant on new thermal generation assets being developed. Nonetheless, the impact of actions by gas majors like Woodside and Shell on the commercial viability of businesses in the manufacturing industry must not be underestimated. Suspension of negotiations on wholesale contracts can cause significant near and even medium-term market disruptions.

Investing in a smooth transition

Overshadowed by the discourse on price caps, but potentially more important in underpinning the energy transition, is the inclusion in the Energy Price Relief Plan of the new Capacity Investment Scheme and the continued roll-out of power transmission capacity augmentation projects under the Rewiring the Nation fund (i.e., accelerated network infrastructure investments that would support increased the uptake of renewables). The Capacity Investment Scheme, unlike previous draft capacity market designs entertained by the Energy Security Board (and the previous Liberal Government), would not be accessible to thermal generators. For coal and gas investors/asset owners this is clearly another signal that whilst short term profits may be attractive, the concept of stranded assets is moving from theoretical construct to a concrete reality in the investment world.

We will closely monitor the market impact of the Energy Price Relief bill over both the short and medium term. However, if anything, 2022 challenged long standing beliefs on key market drivers. In the new year we look forward to exploring with you how these developments may impact your electricity and gas contracting strategies.