Over the last five years, Energetics has witnessed, and in many cases supported, a maturing base of large corporates seeking to enter into a renewable power purchase agreement (PPA) to reduce long term uncertainty from their exposure to the energy and renewable energy certificate markets. Informed buyers of virtual PPAs know that it is not the ‘headline’ PPA strike price, but the production weighted average spot price realised by a project that determines the value of the hedge to the offtake buyer (see our article, "Too much of a good thing? Australia’s abundant solar power and negative prices in the NEM"). Aligning the energy contracted under a PPA with the shape of the buyer’s load may also improve the utility of the hedge and remove generation performance risk from the buyer.

Some buyers are willing to pay a premium for such a volumetric risk transfer.

Renewable energy developers recognise that beyond the short to medium term benefit of exposing a merchant portion to high spot volatility, optimising value and supporting additional investments in the long term may include the sale of shaped or flat renewable energy hedges, aligning with product conventions in the financial markets. Such premium products present material risks. An example was seen during the Texas winter storm ‘Uri’ in February 2020. About a third of wind projects, which were unable to operate due to freezing temperatures, had fixed or proxy volume contracts that resulted in significant exposure to high spot prices during a three-day period[1].

Over the last couple of years, Energetics has been working with investors and renewable energy developers to assess the value premium for such products. We have also undertaken a number of portfolio optimisation analyses to identify combinations of renewable energy and storage assets, potentially coupled with financial products, that provide the most favourable risk-return outcomes under constrained investment capital and risk tolerance.

In this article we explore the issues, insights, and a possible approach to positioning energy investments for success.

An optimisation problem with a lot of moving parts

Constructing an ‘optimal’ renewable energy portfolio investment roadmap over the long-term is certainly a challenge. There are many exogeneous variables (e.g. future spot prices, capital cost, hedging cost, market rule changes) and many controllable components to combine (e.g. generation capacity mix, storage capacity and depth, target volume and hedging structure) even when constraining the problem with a maximum investment target and a maximum risk exposure.

Operational risks can have a significant impact. Unpredictable outages and congestion can occur at any time and during extended periods. Certain hedging instruments are available to reduce the impact of residual spot exposure, but we can expect over-the-counter and exchange-traded products to evolve over time with increasing penetration of variable renewable energy.

How do you choose the ‘best’ portfolio amongst these alternatives? You can easily end up with a hundred cases, thousands of variants and ‘big data analysis paralysis’. Energetics has drawn on both our financial and physical markets expertise and our data analytics capabilities to overcome some of these challenges.

Don’t be paralysed, just get started

There is increasing interest from large commercial and industrial buyers for firmed renewable energy - but firming comes at a price. This premium can be left to electricity retailers as seen in a range of retailer-intermediated product offerings currently available in the market. The premium can also be captured by renewable energy generators taking a portfolio perspective and a merchant hedger role. Combining the target markets and products (e.g. shaped hedge, flat swap, load following product) with the operational performance of a range of physical assets, we can simulate residual spot exposure and possible mitigants. Technology and geographic diversification also come into play.

The incremental effectiveness of reducing residual spot exposure is a function of storage capacity and depth against the mix of renewable energy portfolio contribution (wind vs solar). Plotting a covariance matrix of different renewable energy zones under different weather patterns identifies some preferred combinations from a portfolio dispatch profile perspective.

Once a shortlist of revenue strategies and combined portfolios has been developed, we formulate an investment and hedging strategy as a profit maximisation and risk minimisation problem. Each portfolio can address different product market potentials and include (or not) additional financial hedging products.

Expected risk / return outcomes can be computed for each combination of physical assets and financial contracts in a portfolio and capture reasonably well the dynamics of decisions over time in the face of uncertainty.

Data analytics incorporate the right trade-off between portfolio return and risk

Our methodology for quantifying portfolio performance lies in our Plexos® market simulation model of the National Electricity Market and a large number of stochastic runs. The overall variability of each portfolio is derived mathematically at least for the quantified risks.

Interval data granularity and the long-term time horizon requires a lot of data processing. However this approach provides explicit, quantitative estimates of return and risk considering portfolio diversification as well as covariance between spot prices and portfolio production when:

-

The wind does not blow

-

Sent out generation becomes scarce

-

Prices rise leaving the generator with the tail risk of covering its short position when prices are high.

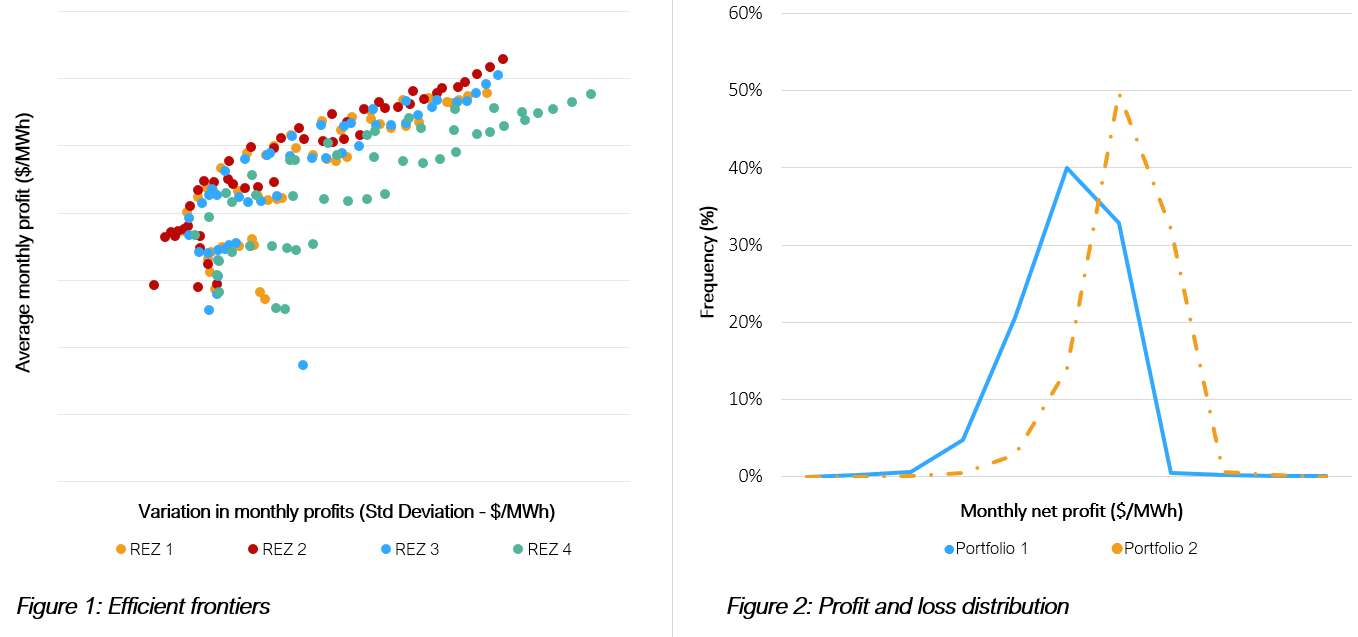

Energetics applies a robust analytical framework, leveraging Markowitz mean-variance portfolio theory, to identify a set of efficient portfolios in the sense of return maximisation for a given expected risk. Using the range of market price forecasts and other variables mentioned above, expected return and its uncertainty can be estimated. The return variability can be calculated as the standard deviation of the portfolio or other risk measures. We then plot each candidate portfolio as a point on a graph where the vertical axis is the expected return, and the horizontal axis is the risk measure related to that return, as illustrated in the figure below.

When comparing portfolios, we are looking for those that present maximum expected return at each given risk level. The line connecting these preferred portfolios is called the efficient frontier.

To better inform discussions about risks, we visualise the distribution of profit and losses of the set of efficient combinations of products, assets and hedging structures as illustrated below.

This technique is further used to determine which factors most affect the diversified portfolio. This is especially important for assessing operational risks (e.g. generation performance, weather patterns, transmission congestion constraints).

Limitations remain, obviously, such as the impact of low market liquidity and the number of assumptions that are needed when pricing financial contracts. Those caveats are worth noting as achieving a workable balance of hedging benefits vs hedging costs is an important business consideration when managing market risk.

Take a portfolio approach

With the specific qualifications related to power markets in mind (e.g. long left-tail risk, high operational risks), there is, in our view, value in leveraging financial portfolio management theory and applying it to the clean energy transition. This approach, which Energetics has now applied to different portfolio construct objectives (e.g. wind firming, deep storage investment value optimisation, new product development) has been very positively received. It supports informed decision making when facing an abundance of portfolio development options under uncertainty. When assessing revenue offtake strategies to drive greater certainty of cash flows and tap a larger pool of market participants, it is possible to estimate which energy investment portfolios and hedging strategies are preferred from a return and risk perspective.

Please contact the authors or your Energetics’ account manager if you have any questions.

[1] Norton Rose Fulbright, 'How hedges have changed since Uri', June 2022