Part one of Anita Stadler's two part series on Large-scale Generation Certificates (LGCs)

Policy uncertainty has been a constant feature of the renewable energy industry in Australia and the lack of a robust long term post-2020 policy continues to undermine investor confidence. Consequently, investment in new renewable energy capacity remains sluggish with a high probability of a shortfall in Large-scale Generation Certificates (LGCs) by 2018.

LGC spot market prices are therefore expected to remain at current levels of above $85 for some time. This is more than double the rate of around $35 that many large energy users locked into retail electricity supply contracts in 2013 and 2014. As the renewable energy power percentage under the Renewable Energy Target (RET) Scheme continues to increase, this will have a material impact on the total energy costs of large energy users.

This article is the first in a two part series which looks at the challenges associated with high LGC prices. In this article, we describe the forces at work and discuss the implications. In the second article, Energetics outlines strategies organisations can pursue in response, such as managing purchases of LGCs for RET compliance purposes.

Will Australia meet its 2020 Renewable Energy Target?

Depending on the mix of solar and wind, approximately 6000MW to 8000MW additional large-scale renewable generation capacity must be installed across the NEM by 2020 to meet the RET. However, rather than commit to new renewable energy projects, most retailers in recent years relied on previously banked LGCs to meet their compliance obligations. This bank is expected to be depleted over the next 18 months.

As it takes approximately 12 months for a utility scale solar project and 18 months for a wind project to become operational, it is estimated that commitment to at least half of this capacity is required during 2016 to avoid a shortfall in LGCs by 2018, which could possibly extend to 2020 and beyond.

However, it is estimated that less than ~1000MW of additional capacity has been committed in 2016 . Furthermore, the Australian Energy Market Operator (AEMO), reports that timelines for committed capacity are shifting out due to delays.

Yet there is no shortage of potential projects. More than 8000MW wind and 2500MW solar projects have obtained development approval. At least a further 6,500MW of projects are in various stages of State development approval. There is also no shortage of international and domestic capital to finance quality projects when policy settings are firm. Some may even argue that, at these high LGC prices, market conditions for utility scale renewable energy investment are attractive as the cost of renewable energy generation continues to decline.

The forces at work

The economics appear to support renewables. Recently, ARENA announced that the cost of large scale solar generation has dropped to just $28/MWh above wind.

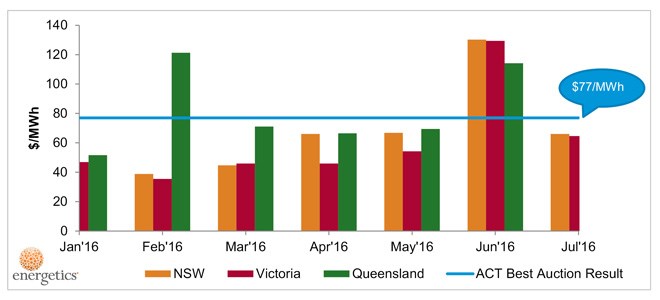

In a recent ACT wind auction, a fixed price of $77/MWh was realised for a bundled power and LGCs offtake from Neoen’s Hornsdale project. This result has been held up as an example of the viability of renewable projects, especially when compared to the AEMO regional reference price (RRP) for electricity across the three largest States in the NEM between January and July 2016. As illustrated below, the price for power was close to the price contracted for both power and LGCs.

Figure 1: ACT wind auction result compared to the AEMO regional reference price for electricity

However, what is often omitted is the fact that the ACT Government offers a 20-year contract to purchase the energy: a time frame that corresponds with the life of the asset.

By contrast the spot market price for LGCs beyond 2020 is very uncertain. Without long term agreements to buy the power generated and / or LGCs (known as offtake agreements), capital is not being committed to new projects because of the high revenue risk over the longer term. Hence, we see the disincentives that are causing delays to progressing new wind and solar projects.

Regulated market dynamics lead to perverse outcomes

To date the main offtake parties under the RET Scheme have been the large vertically integrated energy retailers, as smaller retailers often lack the balance sheet strength required of counterparties in renewable energy project developments. These large vertically integrated retailers own much of the thermal energy (i.e. coal and gas) generation capacity in the National Energy Market (NEM) of which ~75% is beyond its original design life. The AEMO also estimates that 8700MW of coal generation capacity will need to be withdrawn across the NEM to meet the Australian Government’s commitments under the Paris Climate Agreement.

Although demand for electricity has consistently declined since 2010, it stabilised over the last year and is forecast to increase gradually in coming years. We will also see retiring coal fired power stations leading to an increase in the need for new generation capacity, irrespective of the requirements of the RET as demand rises. This is evident from the strong recovery in electricity prices, supported by the return of the demand-supply balance in the NEM.

Under these market conditions, large vertically integrated retailers are able to secure significant margins on generation from coal fired power assets, many of which are near full depreciation. These retailers are understandably reluctant to commit to long term offtake agreements from renewable power projects that will increase the supply capacity of the NEM and drive down prices. To them, a market price for LGCs close to the post-tax LGC penalty price (or scheme price cap) of $93 is irrelevant as it is general practice to pass through RET compliance cost to customers - often with a margin added. Some retailers have recently reported windfall profits from the sale of banked LGCs, where the LGC compliance cost is priced with reference to the spot market for many clients.

The outlook: LGC prices will be close to the penalty rate over the next four years - and possibly longer

Market transitions are always characterised by uncertainty, and the transition of the NEM from predominantly synchronous coal generation to a higher proportion of large scale intermittent renewable generation is no exception (see Energetics’ article on flexible procurement).

However, there are a range of options available to deal with the current market challenges, depending on the risk appetite of the energy user. In the Part 2, ‘Proactive strategies for corporates to drive down the cost of compliance and voluntary LGCs’ Energetics outlines those options in more detail.

For further information and to discuss any aspect of this article, please contact our experts.

NOTE:

The assumptions used within Energetics’ LGC forecast model are based upon the CER’s RET Annual report April 2016 and AEMO National Electricity Forecasting Report 2016 – also released in April. The recently released Electricity Statement of Opportunities (ESOO) 2016 makes certain changes in terminology to align data sources used in the AEMO forecasting model. In particular the Neutral scenario now equates to the achievement of the COP21 emissions reduction target of 28% below 2005 levels by 2030.

For reference see AEMO 2016 NEM ESOO Methodology