The large corporate renewable Power Purchase Agreements (PPAs) announced in 2017 highlighted the range of cost, emissions reduction and community benefits that can come with such deals. Now in early 2018, we see more and more corporates investigating the opportunity as the business case for a PPA with a renewable energy generation project in the right location, and of the right type and size stacks up for most large energy users. In this article we discuss the factors that point to a buyers’ market in 2018, the alternative procurement options and the flexibility in aligning a PPA with your energy market risk exposure.

Why now?

The rationale for using corporate renewable PPAs as a risk management instrument under current market conditions is compelling. Corporates that act in 2018 have a good buying opportunity. Interest rates, a key driver of PPA prices, are still low and there is intense competition amongst new renewable energy projects to secure PPAs in the period up to 2020, which is the target date for the RET. Such corporates will find that 60% or more of the value of a corporate PPA is likely to be realised well before 2025. Delaying will reduce the financial benefit due to the higher LGC and electricity prices, especially in the period to 2021. The market prices for this period are known.

The NEM is complex. Understanding price drivers over the long term.

Many corporates evaluating the corporate PPA opportunity have sought to understand the impact of two major trends on a long term arrangement with a renewable energy generator:

- the predicted fall in Large-scale Generation Certificate (LGC) prices once the Renewable Energy Target (RET) is met around 2020, and

- the expectation that renewable energy technology costs[1] will continue to plummet, driving down market prices for PPAs and delivered electricity.

These are extremely relevant considerations and any assessment of a renewable PPA must take account of the expected drop in electricity and LGC prices from the current elevated levels.

However, the National Electricity Market (NEM) is a complex system with dynamic interactions between climate and energy policy, market regulations, cost of capital and physical system limitations to name a few. These relationships are not linear and the fall in LGC prices and renewable electricity technology costs in our assessment will not result directly in a corresponding fall in electricity prices over the period to 2030. Making an assessment of the relative strength of the drivers of electricity prices is challenging due to the unprecedented transformation of the NEM. However, we at Energetics are confident of three things:

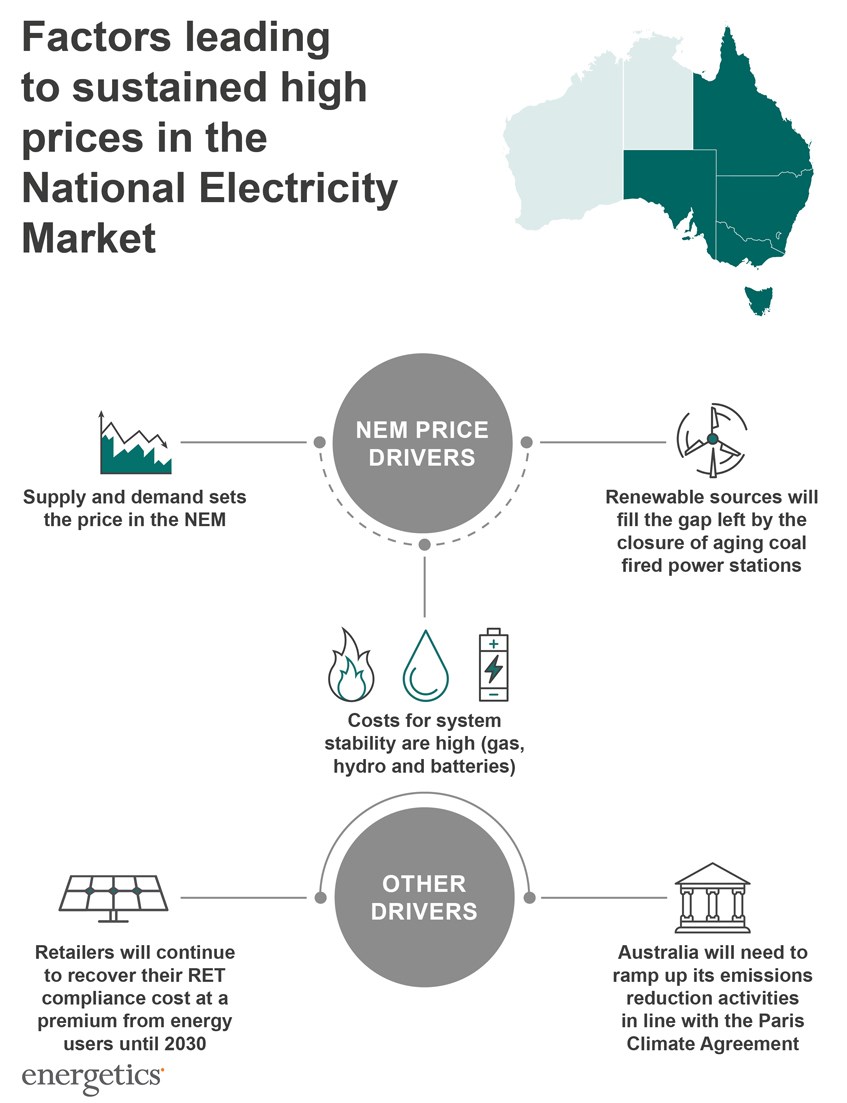

- The future demand and supply balance drives electricity contract prices. For example, the scheduled closure of the NSW Liddell Power Station in 2022 could see high futures contract prices in 2020/2021 for delivery in 2022/2023, even though AGL has provided much more advance notice than we saw with the closure of Hazelwood in 2017.

- Renewable sources are now the cheapest source of new generation, filling the gap left by the closure of aging coal fired power stations.

- The growing reliance on variable renewable sources in the supply mix places increased reliance on flexible, dispatchable sources to ensure system stability. Natural gas, hydro and storage will thus set the wholesale market price for electricity for an increasing proportion of time. The generation costs of all three sources are higher than incumbent coal[2].

The combined influence of the above factors, in our assessment, will result in prices dropping off moderately beyond 2020/21, but will not result in the major fall hoped for by many. In our assessment, the days of gas at $4/GJ and electricity at $40/MWh are well and truly in the past. The new norm is uncertainty and expected to persist over the medium and long term.

Furthermore, beyond the dynamics of the NEM, we are confident that:

- Market prices for LGC prices will drop sharply once the RET target is met, but retailers in all probability will continue to recover their RET compliance costs at a premium from electricity users until 2030 when the scheme is legislated to conclude. Energetics’ analysis of 2017 tender responses showed this premium for 2020 to be close to 15%.

- The global decarbonisation trend is likely to accelerate and as we approach the Paris Climate Agreement's target date of 2030. Australia will need to ramp up its emissions reduction activities to fulfil our international obligations.

Figure 1: Factors leading to sustained high prices in the NEM

What are your energy procurement objectives?

Each corporate’s circumstances are unique, but the two key drivers are broadly:

- energy cost savings and budget certainty

- climate risk exposure and associated sustainability goals.

Are you seeking to hedge against market price risks?

Some corporates are looking to the renewable PPA option to directly reduce or hedge their electricity costs, and may take, for example, a conservative position of committing 20% to 25% of their national electricity load. This provides a source of LGCs to displace mandatory RET compliance charges from retailers, as well as securing a partial shield against volatile and high electricity prices.

The rise of the buying group in 2018

At 20-25%, many corporates may lack the scale to secure very attractive PPA prices. We therefore anticipate that buyers groups will gain in prominence in 2018, at least for corporates that are willing to enter into financial PPAs (i.e. a pure financial arrangement for the value of the electricity, not the supply of electricity to a premise. Gains from this arrangement are anticipated to offset an increase in delivered electricity costs).

Are your energy procurement decisions influenced by your sustainability goals?

Many corporates have sustainability objectives and carbon reduction goals, driven by considerations ranging from sustainability leadership, social licence to operate and greening of supply chains. The value drivers and risk assessment frameworks used by these corporates will support the pursuit of renewable PPAs comprising as much as 100% of their load. Whilst buyers groups may be an option even for these large loads, we anticipate that many will prefer the flexibility of an individual PPA to secure additional value–adds in line with their objectives.

From a low percentage to 100% of your load - a corporate PPA can be designed to meet your needs

Corporates need to assess their electricity and environmental markets exposure and consider the optimal combination of risk retention and risk transfer. By taking a more direct role in managing their energy price risks, corporates are stepping into a new domain and are naturally risk adverse[3]. However, what many may not realise is the flexibility that can be achieved at the design phase of the corporate PPA to ensure that it meets your needs.

It is well worth understanding the value that a long term renewable PPA can create for your corporate, however you need to move quickly - 2018 is the time that this opportunity can be maximised.

Energetics can help large energy users understand the corporate renewable PPA opportunity and the options available. Please contact the author if you have any questions or comments.

References

[1] Note that falling renewable energy technology costs do not translate directly to lower electricity rates as the cost associated with grid connection and generator technical performance standards are expected to increase, offsetting some of the gains from falling renewable energy technology cost. The prevailing low interest rate environment and equity return expectation of some project sponsors support low PPA prices. Upward adjustment in interest rates will push up PPA prices.

[2] Domestic gas supply remains tight, whilst natural gas prices are partly linked to Australian Liquefied Natural Gas (LNG) prices, which are forecast to remain high. Storage will play an increasing role and with economies of scale costs will decline over time. However, it will be high in the medium term.

[3] There are currently no retailers offering a ‘commoditised’ standard retail product offer linking a corporate PPA to power supply; nor do we expect to see one anytime soon.