The Clean Energy Regulator (CER) announced in February 2018 that the Commonwealth’s Renewable Energy Target (RET) of 33,000 GWh by 2020 is likely to be met[1].This target is currently legislated to remain constant until 2030, with emissions reduction requirement contemplated as part of the National Energy Guarantee (NEG)[2] additional to this target.

This assessment is based on the CER’s analysis of committed and probable projects in the development pipeline that are eligible for the creation of Large-scale Generation Certificates (LGCs). Delivery of these projects could be delayed for a range of technical and financial reasons. However, Energetics is in broad agreement that meeting the RET is within reach and that liable entities would be able to meet their obligations in the period leading up to 2020 and beyond. As observed for the 2017 compliance year, some liable entities (wholesale purchasers of electricity) may continue to rely on the carry forward provisions to defer their liabilities to future years.

This article looks at what this means for large electricity users and re-assesses available strategies to mitigate corporates’ exposure to the compliance cost associated with the RET.

How does RET compliance cost impact large corporate electricity users?

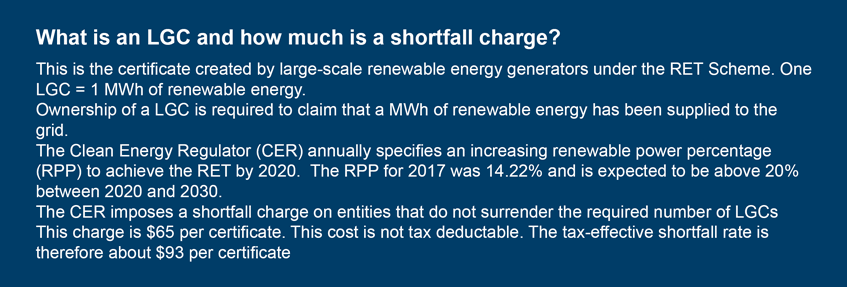

Under the RET scheme liable entities (mostly retailers) must surrender LGCs equal to the MWhs consumed by their customers, multiplied by a percentage specified by the regulator every year to meet the RET. The standard practice is for retailers to on-charge this compliance cost to energy users.

The unprecedented surge in renewable energy investment in 2017 was driven by a recognition from major retailers and corporates that the Commonwealth is unlikely to rescind the RET. New renewable energy capacity was needed to meet the RET and avoid payment of shortfall charges after investment stalled for more than 18 months during the Commonwealth Government’s 2014/15 review of the RET.

Recent price trends and premiums

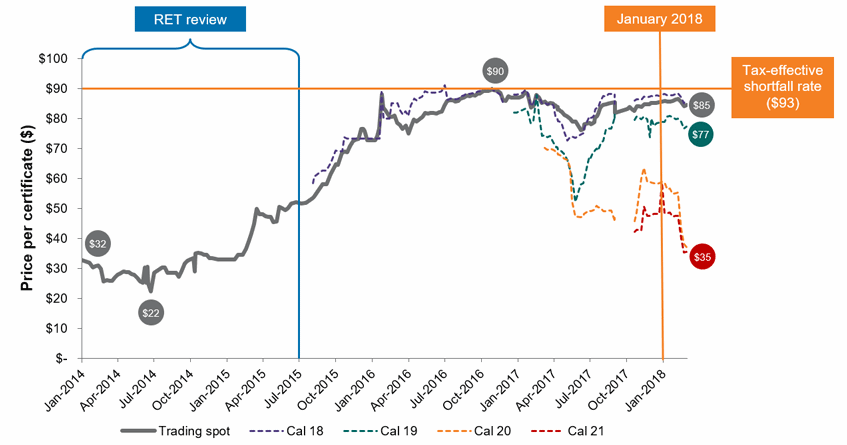

The figure below illustrates the LGC price evolution over recent years and the trajectory of prices for the period to 2021.

In 2014 and 2015 many large energy users paid around $35 per certificate through their retail electricity bills, including the retailer’s margin and administration cost. Following the 2014/15 RET review the price per certificate charged by retailers increased to as much as $93 during 2016/17.

In response to the expected oversupply of certificates by 2020, forward contract prices for delivery of LGCs in 2020 and 2021 have fallen sharply as illustrated below. This drop in prices is now flowing through in the quotations by retailers to corporate energy users. Nonetheless, throughout 2017 we continued to see a premium of about 15% charged by retailers for 2020 LGCs (see our January 2018 article[3] for a more detailed analysis) relative to forward contract prices.

Figure 1: LGC price evolution (January 2014 – March 2018)

What price can corporates expect to pay for LGCs beyond 2020?

Some market commentators suggest that the expected over supply of LGCs in 2020 and beyond means that LGC prices will drop to zero[4]. Unfortunately, in Energetics’ view, this assessment does not mean that electricity users will get a free ride. There are multiple markets for LGCs. When contemplating how to manage your exposure to LGC compliance cost we recommend you take into account the following supply-demand price drivers.

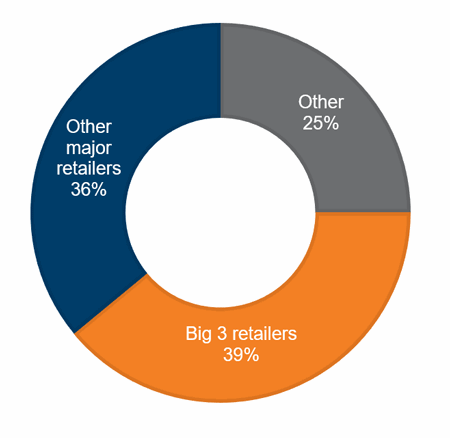

- Electricity retailers control much of the LGC supply and are expected to continue to recover their cost of compliance at a premium from customers[5]. The extent of the retailers’ influence over LGC prices is illustrated by their holdings in the Renewable Energy Certificate Registry as at the end of January 2018. Note that the “other” group holding of 25% includes LGCs for voluntary surrender by institutions such as the ACT Government.

Figure 2: LGC holdings in REC Registry as at 31/01/2018

- An LGC has an emissions reduction value beyond the compliance market. It can be used to offset emission equivalent to the carbon content of one MWh of grid supplied electricity[6]. Holders of LGCs, in surplus to the RET compliance market, could therefore sell these certificates on the voluntary carbon market. The price of Australian Carbon Credit Units (ACCUs) does effectively set a floor price for LGCs. The price for ACCUs currently ranges between $12 and $18 per ton of carbon (tCO2e)[7]. Recent trend has been driven by demand from 16 large emitting facilities that exceeded the emission baseline established under the Emission Reduction Fund Scheme (also referred to as the safeguard mechanism)[8]. In the long term the ACCU price is expected to increase in line with more aspirational targets to decarbonise the Australian and global economy.

With forward contract prices for 2021 certificates trending towards $35 per LGC, it is conceivable that corporates may benefit from sub-$30 LGC prices in the period beyond 2021. However, we do not deem it a foregone conclusion that the LGC price passed through by retailers to electricity users would continue to drop off sharply after that. Even if 100% cost parity is achieved between renewable energy and incumbent coal fired generations, the concentration of market power amongst a handful of retailers and the increasing decarbonisation trend will result in LGCs retaining a market value, at least on par with ACCUs plus a retailer premium.

What can you do to mitigate your risk exposure?

Most large users of electricity continue to accept LGC compliance cost as a pass-through charge from retailers or self-source the volume of LGCs from the market as required, before transferring these LGCs to the retailer to meet its obligation associated with the corporate’s consumption. With the RET scheme legislated to continue until 2030, it is worthwhile to consider options to reduce costs associated with this mandatory charge.

The main options available to corporates to reduce their exposure to LGC cost and price risks are summarised in the following table.

|

Option |

Description |

|

Generation of LGCs through on-site renewable energy projects larger than 100 kW |

This option is viable if a suitable site is available for a large on-site project. The project can be financed though capital investment or an on-site Power Purchase Agreement (PPA). A key benefit of this option is the reduction in network costs associated with reducing consumption at a particular site. |

|

Source LGCs directly from a renewable energy project under medium term contract to transfer to the retailer |

Contract to purchase LGCs to meet the compliance obligation (e.g. 20% of the total load) and self-surrender these to the retailer. This could be a 3 to 5-year agreement. Savings of 20 – 30% on LCG costs is possible depending on the parcel size and duration of the agreement. |

|

Enter into a long term renewable energy PPA for both electricity and LGCs

|

Significant savings is possible if you contract directly with a renewable energy project for both electricity and LGCs. This could be for a portion of your load, such as 20% to 25%, which will generate sufficient LGCs to meet the compliance obligation of the retailer associated with your total load. This is typically a 10-year agreement. However, it has an advantage over an LGC-only contract of also providing you with a partial hedge against future electricity prices increases and volatility. |

At a time of unprecedented market transformation, one may be tempted to “ride out” the storm. However, this will expose organisations to significant market risk as the electricity market transforms over the next 10 to 20 years. Now is not a time to be complacent. The sooner you take control of your LGC supply, the greater the opportunity to reduce cost over the medium term when prices are known and markedly elevated.

Energetics has a team of experienced energy and environmental market; as well as policy specialists that can guide you through an assessment of your risk exposure to mandatory LGC charges.

References

[1] Clean Energy Regulator | Surplus of large-scale generation certificates after final surrender

[2] The NEG is the new energy policy under development, following the release of the Chief Scientist’s Independent Review into the Future Security of the National Electricity Market (i.e. Finkel Review) released in June 2017

[3] Energetics | It’s not just price – a corporate renewable PPA is a risk management strategy

[4] RenewEconomy | Renewable Energy Market Report: Traders doubt regulator’s confidence of project timelines

[5] This cost is likely to be a blend of LGCs procured under long term contracts over the life of the scheme, and short term spot market purchases as buying opportunities emerge.

[6] The emission intensity of 1 MWh of electricity varies depending on the State or Territory the renewable energy project is located in. However, the 2017 average emission intensity of 1 MWh of grid connected electricity was 0.8 tCO2e per MWh. This will decrease over time in line with the increase in renewable energy in the supply mix (see: Clean Energy Regulator |Electricity sector emissions and generation data 2016–17)

[7] Australian Financial Review | Carbon price jumps in maiden run for Tony Abbott's emissions trading scheme

[8] This scheme was introduced by the Coalition Government to replace the carbon tax introduced by the previous Labour government.